If you’re wondering, “How do I buy Whalebit CES on MEXC without getting rekt by fees or scams?” – you’ve landed in the right spot. This isn’t some fluffy overview; it’s a battle-tested, step-by-step guide optimized for beginners and pros alike.

I’ll walk you through everything from understanding $CES’s explosive potential to executing your first trade, securing your assets, and even spotting trading opportunities that could multiply your stack. Stick around till the end—I’ve got pro tips on staking CES for passive gains and why this token might be your ticket to the next bull run. Let’s start trading like a pro.

Whalebit (CES) – the utility token that’s not just another crypto, but the key to unlocking a vibrant ecosystem on the Polygon blockchain. Having spent over a decade in the forefront of blockchain innovation as a seasoned blogger, crypto trader, and tech professional, I have witnessed the rise and fall of various tokens.

But CES? It’s got that rare spark – blending DeFi, GameFi, and VR in a way that’s drawing in whales and minnows alike. And with its recent listing on MEXC, one of the fastest-growing exchanges for emerging tokens, now’s the time to dive in.

What is Whalebit CES?

Before you place your bet, let’s delve into the true nature of Whalebit CES. Launched in 2025 on the Polygon blockchain, CES isn’t your average meme coin or hype-driven pump – it’s the backbone of the Meta Whale ecosystem, a gamified universe where gaming meets real earning potential.

At its core, Whalebit (CES) serves as the utility and governance token. Want to buy digital assets? CES. Participate in exclusive events or governance votes?

CES again. It’s integrated across DeFi apps, liquidity provision on their W-DEX (a decentralized exchange on Polygon), and even educational tools like Whale-Academy. With a max supply capped around 422 million tokens, scarcity plays a role in its value proposition, especially as adoption grows.

Why Build Whalebit CES on Polygon?

Low fees, lightning-fast transactions, and scalability make it ideal for a metaverse play. $CES holders can freeze tokens for discounts in games or level-ups, reducing sell pressure and encouraging long-term holding – a smart tokenomics move I’ve seen work wonders in projects like SAND or MANA back in the day.

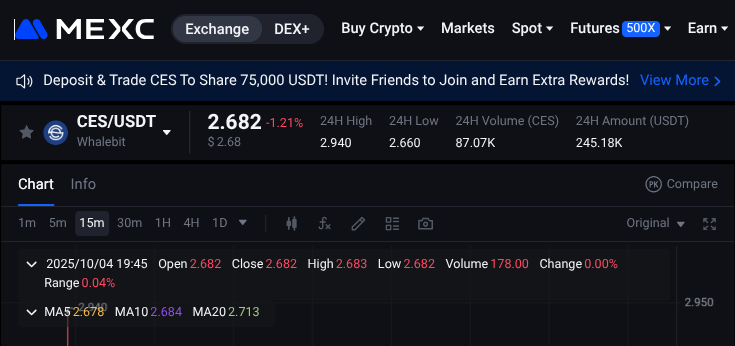

As of October 2025, CES is trading around $3-5 USD, with wild swings – up 50% in 24 hours at peaks, trading volumes hitting millions, and an all-time high pushing $5.88. The fully diluted valuation (FDV) has the potential to reach billions, indicating room for growth if the ecosystem delivers.

But here’s the hook: Meta Whale isn’t stopping at gaming. Upcoming integrations like the MetaW metaverse and expanded NFT drops mean CES could power a full-fledged digital economy. In my trading career, tokens tied to real utility like this often outperform pure spec plays.

If you’re into Web3, CES is worth watching – and buying on MEXC positions you early. Next, we will discuss why MEXC is your best bet for securing CES without the drama.

Why Choose MEXC to Buy Whalebit CES

In the wild world of crypto exchanges, not all platforms are created equal—especially for hot new listings like Whalebit CES. MEXC stands out as a powerhouse, established in 2018 and now serving over 40 million users with a focus on speed, low fees, and early access to tokens.

Why? They’re notorious for listing trending tokens first—think memecoins, DeFi gems, and GameFi stars like CES—often before the masses pile in.

MEXC offers over 2,800 coins, zero spot trading fees for makers, and deep liquidity to minimize slippage on volatile assets like CES. Their P2P marketplace supports 100+ fiat options, perfect for buying USDT or BTC with your local currency, then swapping for CES.

Security? Top-tier with bi-monthly proof-of-reserves over 100%, an insurance fund topping $500M, and no major hacks in years.

For tech pros like me, MEXC’s API and advanced tools shine – automate trades, set stop-losses, or dive into futures if you’re leveraging up on CES pumps.

Available globally (barring restricted regions like the US or China), it’s mobile-friendly with apps on iOS and Android boasting clean UIs and quick executions. Compared to DEXes like W-DEX where CES trades, MEXC cuts gas fees and adds fiat on-ramps – crucial for scaling your position.

The real kicker? MEXC’s airdrops and staking rewards – hold MX (their native token) for up to 60% APY, or stake CES post-purchase for ecosystem perks. In a market where timing is everything, MEXC’s edge on listings like CES’s recent debut means you’re not FOMOing into peaks. Ready to sign up? Let’s cover the basics to get you onboarded safely.

Buy Whalebit CES on MEXC

Getting started on MEXC is straightforward – no PhD in blockchain required. Please visit mexc.co or consider downloading the app.

Sign Up on MEXC

Click “Sign Up” and use email or phone—I recommend email for recovery ease. Please create a strong password by combining letters, numbers, and symbols, and enable 2FA using Google Authenticator at your earliest convenience. This provides an additional layer of protection against phishing, which is a trader’s greatest concern.

MEXC Account Verification (KYC)

Next, verification (KYC). For basic trading, you might skip it, but for fiat deposits and higher limits, complete Level 1: Upload ID (passport/driver’s license) and a selfie. It takes minutes, and MEXC processes fast – often under 24 hours.

Pro tip: Use a dedicated email for crypto to compartmentalize risks. Once verified, you’re golden – access spot, futures, and P2P markets. In my decade of trading, skipping KYC on reputable exchanges like MEXC limits you unnecessarily; better safe with compliance.

MEXC Wallet Funding

Now, fund your account. Options abound: Buy crypto directly with credit/debit cards (Visa/Mastercard), bank transfers (SWIFT/FedWire), or P2P trades.

For CES, start with USDT – stable and pairs perfectly. Via P2P, select sellers with high ratings, choose your fiat (USD, EUR, etc.), and complete the trade securely in-app.

Fees? There is minimal, often zero, opportunity for takers. Deposit crypto from another wallet? Scan the QR code or copy the address, and double-check the network: most tokens use ERC-20, but CES uses Polygon, so bridge if necessary.

With funds in, search “CES” in the spot market – MEXC’s interface shows real-time prices, charts, and order books. Place a market order for instant buys or limit for your price target. Boom – CES is yours. But wait, there’s more: Secure it properly before we dive deeper.

How to Fund Your MEXC Account

Funding is where newbies trip up – but not you. MEXC’s “Buy Crypto” section is idiot-proof.

Fiat Funding Method:

A credit card buys USDT instantly, with fees under 2–3%. Bank transfer? The service is free for larger amounts, but slower (1-3 days).

P2P shines for locals – trade cash for USDT via PayPal, Apple Pay, or bank wires, escrow-protected.

Crypto Funding Method:

Send BTC, ETH, or USDT from wallets like MetaMask or Coinbase. Always match networks to avoid losses – Polygon for CES-related, but USDT often on TRC-20 for cheap fees. I always withdraw a test amount first to verify addresses. Once funded, swap to CES pairs like CES/USDT – liquidity ensures smooth trades even during volatility.

Advanced Funding Method:

Use MEXC’s API for automated funding if you’re botting trades. In bull markets, use stablecoins to fund investments and hedge against dips. This setup positions you for CES’s next pump—but trading smart is key.

Buying Whalebit CES on MEXC Spot Market

Spot trading CES on MEXC is pure adrenaline. From the dashboard, hit “Spot,” search “CES/USDT,” and boom – charts load with candlesticks, volume, and indicators like RSI/MACD. Market order: Enter amount, hit buy – instant at current price (~$3-5). Limit: Set your entry (e.g., below support for value).

As a trader, I watch order books for walls – big buys signal support. Fees? 0% maker, 0.02% taker—stack-friendly. Post-buy, $CES lands in your spot wallet. For leverage? Futures tab offers up to 125x, but DYOR – volatility can wipe margins.

Pro move: Use stop-limits to lock profits. Given CES’s 58% weekly gains, timing entries based on news events, such as MEXC listings, is highly advantageous. Now, secure your bag.

Advanced Trading Strategies for Whalebit CES on MEXC

Beyond basics, level up with strategies I’ve honed over years. Scalping: Quick in-out on CES dips, using MEXC’s low latency. Swing trading: Hold for metaverse news, targeting 20-50% swings based on Polygon ecosystem trends.

Futures: Long CES if bullish on GameFi, with take-profits at ATH levels ($5+).

Arbitrage: Buy low on W-DEX, sell high on MEXC – but gas eats profits. Staking: Lock CES for ecosystem rewards, boosting APY.

Risk management: Never risk >2% per trade, diversify, and track sentiment via MEXC tools. CES’s proxy contract warrants caution – monitor updates. These tactics turned my portfolio – yours next?

Security Best Practices: Protecting Your CES Holdings

Crypto’s thrilling, but hacks lurk. On MEXC, enable anti-phishing codes, use hardware wallets (Ledger/Trezor) for withdrawals, and never share seeds. Withdraw CES to self-custody post-buy – Polygon-compatible like MetaMask.

Avoid scams: Fake sites, airdrop phishing. Use MEXC’s insurance fund as backup. I’ve lost (and recovered) – lesson: Multi-sig for big stacks.

Whalebit CES Price Analysis

CES trades volatile – $2.64 ATL to $5.88 ATH, with recent 50% surges. Bullish on metaverse hype, Polygon scaling. Predictions: $4+ short-term, potential 200%+ by 2030 if adoption hits.

As a tech pro, CES’s utility edges it over hype coins. Watch volumes – $18M+ signals strength. Long-term: Metaverse boom could 10x it.

Common Mistakes to Avoid When Buying CES on MEXC

FOMO buys at peaks? Check. Ignoring fees/gas? Rookie. Emotional trading without stops? Rekt city. Always research tokenomics, verify listings. Don’t over-leverage – CES’s swings amplify losses.

Conclusion: Ride the Whalebit Wave—Your Next Move

You’ve got the full playbook: From CES’s metaverse magic to trading on MEXC like a pro. With its utility, listings, and growth potential, Whalebit CES could be a portfolio cornerstone. Sign up, make informed purchases, secure your assets—and watch your investments grow.

Questions? Drop ’em below. Trade safe, stack sats (or $CES), and here’s to your next 10x.

Discover more from Digital Wealth Guru

Subscribe to get the latest posts sent to your email.

Comments