Passive income means earning money that requires little or no ongoing effort. It’s like planting seeds and watching them grow – you put in the initial work, but then the system generates income over time for you.

Let’s face it, the traditional 9-to-5 grind isn’t for everyone. In 2025, the desire for financial freedom and flexible schedules is stronger than ever. This is where the magic of passive income comes in.

The good news? You don’t need to be a millionaire or a tech whiz to get started with passive income. Multiple beginner-friendly options can help you build a steady stream of extra cash.

In this post, we’ll explore 20 of the best passive income ideas for beginners in 2025. We’ll cover a range of options, from leveraging your existing skills to exploring new ventures. So, whether you’re a creative soul, a tech enthusiast, or simply looking to maximize your resources, there’s bound to be an idea that piques your interest. Below are the Passive income ideas we will be discussing in detail.

- Create a course

- Write an e-book

- Rental income

- Affiliate marketing

- Flip retail products

- Sell photography online

- Buy crowdfunded real estate

- Peer-to-peer lending

- Dividend stocks

- Create an app

- Rent out a parking space

- REITs

- A bond ladder

- Sponsored posts on social media

- Invest in a high-yield CD or savings account

- Rent out your home for short-term

- Advertise on your car

- Create a blog or YouTube channel

- Rent out valuable household items

- Sell designs online

Before We Dive In: A Reality Check on Passive Income

While passive income is a fantastic way to boost your finances, it’s important to have realistic expectations. Most passive income streams require some upfront effort to set up and some ongoing maintenance. Don’t expect to get rich quickly with minimal work.

However, with dedication and consistency, passive income can become a powerful tool for achieving financial goals, building wealth, and, ultimately, freeing up your time.

What Is Passive Income?

Passive income includes regular earnings from sources other than an employer or contractor. The Internal Revenue Service (IRS) says passive income can come from two sources: rental property or a business in which one does not actively participate, such as being paid book royalties or stock dividends.

“Many people think that passive income is about getting something for nothing,” says financial coach and retired hedge fund manager Todd Tresidder. “It has a ‘get-rich-quick’ appeal… but in the end, it still involves work.” You just give the work upfront.”

You may do some or all of the work upfront, but passive income often involves additional labor. To keep the passive dollars flowing, keep your product update property well-maintained.

But if you’re committed to the strategy, it can be a great way to generate income and create extra financial security for yourself.

Passive Income Is NOT

- Your job. Generally, passive income is not from something you’ve been materially involved in, such as the wages you earn from a job.

- A second job. Getting a second job doesn’t qualify as a passive income stream because you’ll still need to show up and do the work to get paid. Passive income is about creating a consistent income stream without having to do a lot of work.

- Non-income-producing assets can be a great way to generate passive income, but only if the assets you own pay dividends or interest. Non-dividend-paying stocks or assets like cryptocurrencies may be exciting, but they won’t earn passive income.

20 Passive Income Ideas For Beginners in 2025

If you’re thinking about creating a passive income stream, check out these 20 strategies and learn what it takes to be successful with them while also understanding the risks associated with each idea.

1. Create a course

One popular strategy for passive income is creating an audio or video course, then kicking back while cash rolls in from the sale of your product. Courses can be distributed and sold through sites such as Udemy, SkillShare, and Coursera.

Alternatively, you might consider a “freemium model”—building up a following with free content and then charging for more detailed information or for those who want to know more. For example, language teachers and stock-picking advisors may use this model.

The free content demonstrates your expertise and may attract those looking to go to the next level.

Opportunity: A course can deliver an excellent income stream because you make money quickly after the initial outlay of time.

Risk: “It takes a massive amount of effort to create the product,” Tresidder says. “And to make good money from it, it has to be great.” There’s no room for trash out there.

Tresidder says you must build a robust platform, market your products, and plan for more products to succeed.

“One product is not a business unless you get really lucky,” Tresidder says. “The best way to sell an existing product is to create more excellent products.”

“Once you master the business model, you can generate a good instream, “Ream says.

2. Write an E-Book

Writing an e-book is an excellent opportunity to take advantage of the low cost of publishing and even leverage the worldwide distribution of Amazon to get your book seen by millions of would-be buyers. E-books can be short, 30-50 pages, and relatively cheap to create since they rely on your expertise.

You’ll need to be an expert on a specific topic, but the topic could be niche and use some special skills or abilities that very few offer but that many readers need. You can quickly design the book on an online platform and then even test-market different titles and price points.

But just like designing a course, a lot of the value comes when you add more e-books to the mix, drawing in more customers to your content.

Opportunity: An e-book can function not only to deliver good information and value to readers but also as a way to drive traffic to your other offerings, including audio or video courses, other e-books, a website, or potentially higher-value seminars.

Risk: Your e-book has to be very strong to build up a following,g and then it helps if you have some way to market it, too, such as an existing website, promotion on other relevant websites, appearances in the media, podcasts, or something else. You could put in a lot of work upfront and get very little back for your efforts, especially at first.

While an e-book is excellent, it will help if you write more and then even build a business around the book or make the book just one part of your business that strengthens the other parts. So, your most significant risk is wasting your time with little reward.

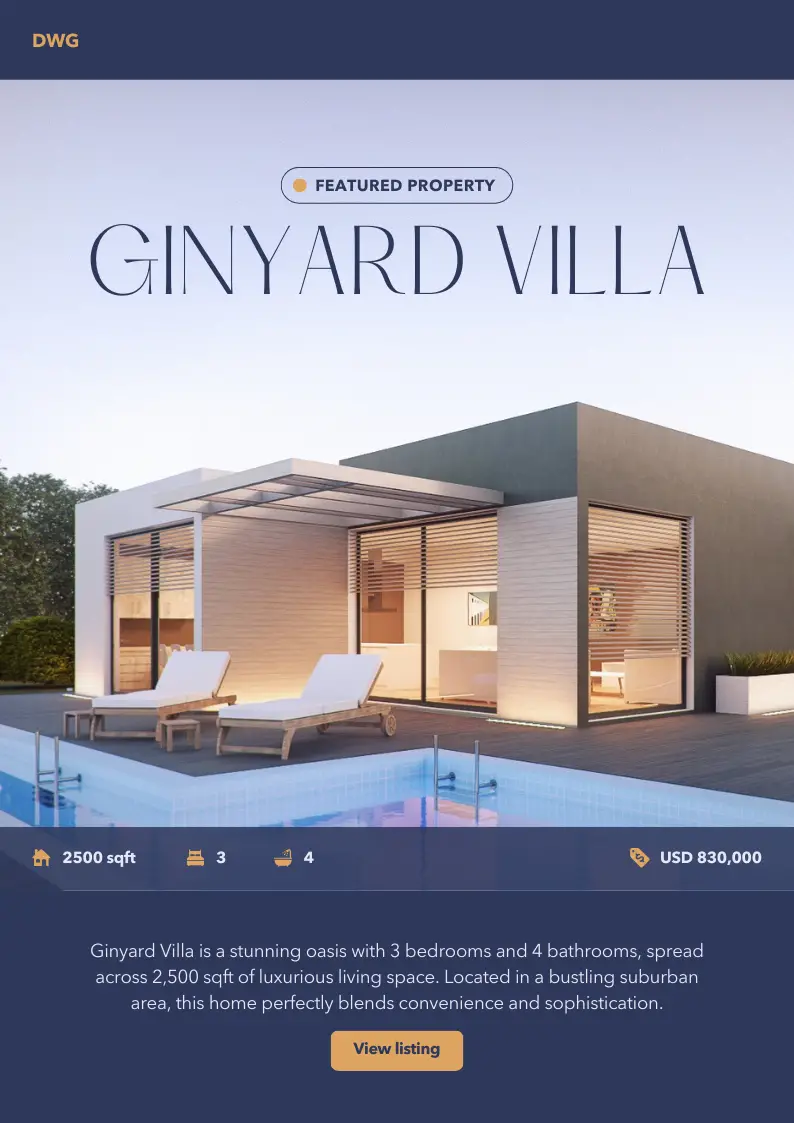

3. Rental income

Investing in rental properties is an effective way to earn passive income. But it often requires more work than people expect.

Suppose you don’t take the time to learn how to make it profitable. In that case, you could lose your investment. Then some, says John H. Graves, an Accredited Investment Fiduciary (AIF) in the Los Angeles area and author of “The 7% Solution: You Can Afford a Comfortable Retirement.”

Opportunity: To earn passive income from rental properties, Graves says you must determine three things:

- How much return do you want on the investment

- The property’s total costs and expenses

- The financial risks of owning the property

For example, if your goal is to earn $10,000 a year in rental cash flow, and the property has a monthly mortgage and another $300 a month for taxes and other expenses, you’d have to charge $3,133 in monthly rent to reach your goal.

Risk: A few questions to consider: Is there a market for your property? What if you get a tenant who pays late or damages the property? What if you’re unable to rent out your property? Any of these factors could put a big dent in your passive income.

And economic downturns can pose challenges, too. You may suddenly have tenants who can no longer pay their rent, while you may still have a mortgage of your own to pay. Or you may not be able to rent the home out for as much as you could before as incomes decline.

Home prices have been rising quickly due in part to relatively low mortgage rates, so your rents may not be able to cover your expenses. You’ll want to weigh these risks and have contingency plans to protect yourself.

4. Affiliate marketing

With affiliate marketing, website owners, social media “influencers,” or bloggers promote a third party’s product by including a link to it on their site or social media account. Amazon might be the best-known affiliate partner, but eBay, Awin, and ShareASale are among the more notable names.

Instagram and TikTok have become massive platforms for those looking to grow a following and promote products.

Consider growing an email list to draw attention to your blog or direct people to products and services they might want.

Opportunity: When a visitor clicks on the link and purchases from the third-party affiliate, the site owner earns a commission. The commission might range from 3 to 7 percent, so it will likely take significant traffic to your site to generate a high income. But if you can grow your following or have a more lucrative niche (such as software, financial services, or fitness), you can make a serious coin.

Affiliate marketing is passive because, in theory, you can earn just by adding a link to your site or social media account. You won’t earn anything if you can’t attract readers to your site to click on the link and buy something.

Risk: If you’re just starting, you’ll have to take time to create content and build traffic. Building a following can take significant time, and you’ll have to find the right formula for attracting that audience, a process that might take a while. Worse, once you’ve spent all that energy, your audience may be apt to flee to the following famous influencer, trend, or social media platform.

5. Flip retail products

Take advantage of online sales sites like eBay or Amazon and sell products you find at cut-rate prices elsewhere. You’ll arbitrage the difference in your purchase and sale prices and maybe be able t build to a following of individuals who track your deals.

Opportunity: You’ll be able to take advantage of price differences between what you can find and what the average consumer may be able to find. These could work exceptionally well if you have a contact to help you access discounted merchandise that few others can find. Or you may be able to find valuable merchandise that others have simply overlooked.

Risk: While sales can happen at any time online, helping to make this strategy passive, you’ll have to hustle to find a reliable source of products. Plus, you’ll have to invest money in your products until they sell, so you need a rich source of cash. You’ll have to know the market so you’re not buying at a price that’s too high. Otherwise, you may end up with products that no one wants or whose price you have to cut drastically.

6. Sell photography online

Selling photography online might not be the most obvious place to set up a passive business, but it could allow you to scale your efforts, mainly if you can sell the same photos repeatedly. To do that, you might work with an organization such as Getty Images, Shutterstock, or Alamy.

To get started, you’ll have to be approved by the platform, and then you license your photos to be used by whoever downloads them. The platform then pays you every time someone uses your photo.

You’ll need photos that appeal to a specific audience or represent a particular scene, and you’ll need to tease out where the demand is. Photos could be shots with models, landscapes, or creative scenarios, or they could capture events that might make the news.

Opportunity: Part of the value of selling or licensing your photos through a platform is that you have the potential to scale your efforts, primarily if you can provide pictures that will be in demand. That means you could sell the same image hundreds or thousands of times.

Risk: You could add hundreds of photos to a platform such as Getty Images without generating meaningful sales. Only a few photos may drive your revenue, so you must keep adding photos as you search for that needle in the haystack.

It may require substantial effort to go out and shoot photos, then process them and keep up with the events that may ultimately drive your revenue. And motivation could be hard to maintain: Every next photo might be your lottery ticket, though it almost certainly won’t be.

7. Buy crowdfunded real estate

Suppose you’re interested in investing in real estate but don’t want to do much of the heavy lifting (management, repairs, handling tenants, and more). In that case, another option is using a crowdfunding platform to invest in property. An experienced investing team picks out the real estate, and then you can decide to invest in it and how much you’re comfortable with.

You’ll pay an annual management fee to the real estate platform and have minimum investment amounts ranging from ten to tens of thousands of dollars.

Opportunity: You can access private real estate deals that may be attractive, and knowledgeable investors have preselected them. You can check out the returns on the platforms, so you’ll have some idea of what level of returns you can expect and over what time frame. Real estate investments can also help diversify your portfolio, helping to smooth your returns.

Some platforms invest in equity (stock), while others invest in debt. Generally, the stock offers high returns in exchange for more risk, while debt offers lower returns in exchange for less risk. Some platforms require you to be an accredited investor with a certain minimum income or assets. Popular platforms include Fundrise, Yieldstreet, and DiversyFund.

Risk: You’re on the hook to make investments on many crowdfunding platforms. So, while past returns may look good, they’re no predictor of future success. And you’ll have to make the judgment call about what to buy. That means you’ll need to read the prospectus for every deal you’re interested in and understand the pros and cons.

In addition, real estate is typically funded with high levels of debt financing, making it more susceptible to any economic downturn. You’ll also want to understand how long your money will be locked up in the investment and when you can access it, especially in an emergency.

8. Peer-to-peer lending

A peer-to-peer (P2P) loan is a personal loan between you and a borrower, facilitated through a third-party intermediary such as Prosper or LendingClub. Other players include Funding Circle, which targets businesses with higher borrowing limits, and Payoff, which targets better credit risks.

Opportunity: As a lender, you earn income via interest payments made on the loans. But because the loan is unsecured, you could end up with nothing in the event of a default.

To cut that risk, you need to do two things:

- Diversify your lending portfolio by investing smaller amounts over multiple loans. At Prosper.com and LendingClub, the minimum investment per loan is $25.

- Analyze historical data on prospective borrowers to make informed picks.

Risk: It takes time to master the metrics of P2P lending, so it’s not entirely passive, and you’ll want to vet your prospective borrowers carefully. Since you’re investing in multiple loans, you must pay close attention to the payments received. Whatever you make in interest should be reinvested if you want to build an income.

Economic recessions can also make high-yielding personal loans a more likely candidate for default, so these loans may go wrong at higher than historical rates when the economy worsens.

9. Dividend stocks

Shareholders in companies with dividend-yielding stocks receive a payment at regular intervals from the company. Companies pay cash dividends every quarter out of their profits, and all you need to do is own the stock. Dividends are paid per share of stock, so the more shares you own, the higher your payout.

Opportunity: Since the stock income isn’t related to any activity other than the initial financial investment, owning dividend-yielding stocks can be one of the most passive forms of making money. The money you invested will simply be deposited in your brokerage account.

Risk: The tricky part is choosing the right stocks.

For example, companies issuing a very high dividend may need help to sustain it. Graves warns that too many novices jump into the market without thoroughly investigating the company issuing the stock. “You’ve got to investigate each company’s website and be comfortable with their financial statements,” Graves says. “You should spend two to three weeks investigating each company.”

That said, there are ways to invest in dividend-yielding stocks without spending much time evaluating companies. Graves advises going with exchange-traded funds or ETFs. ETFs are investment funds that hold assets such as stocks, commodities, and bonds, but they trade like stocks.

ETFs also diversify your holdings, so if one company cuts its payout, it doesn’t affect the ETF’s price or dividend too much. Here are some of the best ETFs to choose from.

“ETFs are an ideal choice for novices because they are easy to understand, highly liquid, inexpensive and have far better potential returns because of far lower costs than mutual funds,” Graves says.

Another critical risk is that stocks or ETFs can move down significantly in short periods, especially during times of uncertainty, as in 2020 when the coronavirus crisis shocked financial markets. Economic stress can cause some companies to cut dividends, while diversified funds may feel less of a pinch.

Compare your investing options with Bankrate’s brokerage reviews.

10. Create an app

Creating an app could be a way to make that upfront investment of time and then reap the reward over the long haul. Your app might be a game or one that helps mobile users perform some hard-to-do functions. Once your app is public, users download it, and you can generate income.

Opportunity: An app has a huge upside if you can design something that catches the fancy of your audience. You’ll have to consider how best to generate sales from your app. For example, you might run in-app ads or have users pay a nominal fee for downloading the app.

If your app gains popularity or you receive feedback, you’ll likely need to add incremental features to keep the app relevant and popular.

Risk: The most significant risk here is using your time unprofitably. If you commit little or no money to the project (or money that you would have spent anyway, for example, on hardware), you have little financial downside here. However, it’s a crowded market, and genuinely successful apps must offer users a compelling value or experience.

You’ll also want to ensure that if your app collects any data, it complies with privacy laws, which differ across the globe. The popularity of apps can be short-lived, too, meaning your cash flow could dry up faster than you expect.

11. Rent out a parking space

Do you have a parking space you’re not using or could be used by someone else? You could trade that spot for some cash. It could be an even better set-up if you have a larger area that could fit several cars or be useful for multiple events or venues.

Opportunity: Your parking spot could be worth real money in particular high-demand areas or during high-demand times (for example, during a concert or sporting event).

For example, if you live near a place with frequent commuters but are strapped for parking spots, you might have a money-maker on your hands. You have the best chance of turning a profit by renting to someone who needs the spot daily rather than for one-off events.

Risk: This idea might not be hazardous, but you want to ensure you aren’t violating any restrictions from your residence or other entity by renting out a parking space. It’s probably worthwhile to have a disclaimer of liability as a condition of parking in your spot, too.

12. REITs

A REIT is a real estate investment trust, a fancy name for a company that owns and manages real estate. REITs have a unique legal structure so that they pay little or no corporate income tax if they pass along most of their income to shareholders.

Opportunity: You can purchase REITs on the stock market like any other company or dividend stock. You’ll earn whatever the REIT pays out as a dividend, and the best REITs have a record of increasing their dividend annually so that you could have a growing stream of dividends over time.

Like dividend stocks, individual REITs can be riskier than owning an ETF consisting of dozens of REIT stocks. A fund provides immediate diversification and is usually a lot safer than buying individual stocks — and you’ll still get a nice payout.

Risk: Just like dividend stocks, you’ll have to be able to pick the good REITs, and that means you’ll need to analyze each of the businesses that you might buy — a time-consuming process. And while it’s a passive activity, you can lose a lot of money if you don’t know what you’re doing. Like any stock, the price can fluctuate a lot in the short term.

REIT dividends are not protected from tough economic times, either. If the REIT doesn’t generate enough income, it will likely have to cut its dividend or eliminate it. So, your passive income may get hit just when you want it most.

13. A bond ladder

A “bond ladder” is a series of bonds that mature at different times over the years. The staggered maturities let you lower the risk of reinvestment risk, which is the risk of putting your money back into bonds that pay too little interest.

Opportunity: A bond ladder is a classic passive investment that retirees and people getting close to retirement have liked for decades. You can sit back and collect your interest payments, and when the bond matures, you “extend the ladder,” rolling that principal into a new set of bonds. For example, you might start with bonds of one year, three years, five years, and seven years.

In a year, when the first bond matures, you have bonds remaining for two years, four years, and six years. You can use the proceeds from the recently matured bond to buy another year’s worth or roll it out to a longer duration, for example, an eight-year bond.

Risk: A bond ladder eliminates one of the significant risks of buying bonds: when your bond matures, you have to buy a new bond when interest rates might not be favorable.

Bonds come with other risks, too. While the federal government backs Treasury bonds, corporate bonds are not, so you could lose your principal if the company defaults. You’ll want to own many bonds to diversify your risk and eliminate the risk of any single bond hurting your overall portfolio. If overall interest rates rise, it could push down the value of your bonds.

Because of these concerns, many investors turn to bond ETFs, which provide a diversified fund of bonds you can set up on a ladder, eliminating the risk of a single bond hurting your returns.

14. Sponsored posts on social media

Do you have a solid social following on Instagram or TikTok? Get growing consumer brands to pay you to post about their product or otherwise feature it in your feed.

You’ll need to keep filling your profile with content that draws in your audience. And that means continuing to create posts that grow your reach and engage your followers on social media.

Opportunity: Leveraging your social media presence is an attractive business model. Draw eyeballs and clicks to your profile with solid content, and then monetize that content by setting up sponsored posts from brands that appeal to your followers.

Risk: Getting started here can be a Catch-22: You need a large audience to get meaningful sponsored posts, but you’re not an attractive option until you get a meaningful audience. So you’ll have to focus a lot of time first on growing your audience, with no guarantee that you’ll be successful. You can spend tons of time following the trends and building content to get the sponsorship you’re aiming for eventually.

Even when you’ve got the sponsored posts you’re looking for, you’ll need to keep posting to draw in your audience and remain an attractive option for advertisers. That means committing to more time and monetary investment, even if you do have a lot of autonomy on exactly when to do it.

15. Invest in a high-yield CD or savings account

Investing in a high-yield certificate of deposit (CD) or savings account at an online bank can generate a passive income and get one of the highest interest rates in the country. You won’t even have to leave your house to make money.

Opportunity: You’ll want to quickly search the nation’s top CD rates or savings accounts to make the most of your CD. It’s usually much more advantageous to go with an online bank rather than your local bank, because you’ll be able to select the top rate available in the country. And you’ll still enjoy a guaranteed return of principal up to $250,000 if the FDIC backs your financial institution.

Risk: Your principal is safe if your bank is backed by the FDIC and within limits. Investing in a CD or savings account is about as safe a return as possible. However, while these accounts are safe, they’re returning less these days than before.

That return can pale compared to inflation, which hit mid-single digits last year, hurting the real purchasing power of your money. Nevertheless, a CD or savings account will yield better than holding your money in cash or a non-interest-bearing checking account where you’ll receive nothing.

16. Rent out your home for short-term

This straightforward strategy takes advantage of space you’re not using and turns it into a money-making opportunity. If you’re going away for the summer, have to be out of town for a while, or maybe even just want to travel, consider renting out your current space while you’re gone.

Opportunity: You can list your space on any number of websites, such as Airbnb, and set the rental terms yourself. You’ll collect a check for your efforts with minimal extra work, especially if joining to a tenant who may be in place for a few months.

Risk: You don’t have a lot of financial downsides here, though letting strangers stay in your house is a risk that’s atypical of most passive investments. For example, tenants may deface or even destroy your property or steal valuables.

17. Advertise on your car

You can earn some extra money by simply driving your car around town. Contact a specialized advertising agency, which will evaluate your driving habits, including where you drive and how many miles. If you’re a match with one of their advertisers, the agency will “wrap” your car with the ads at no cost to you. Agencies are looking for newer cars, and drivers should have a clean driving record.

Opportunity: While you have to get out and drive if you’re already putting in the mileage, this is a great way to earn hundreds per month with little or no extra cost. Drivers can be paid by the mile.

Risk: If this idea looks interesting, be extra careful to find a legitimate operation to partner with. Many fraudsters set up scams in this space to try and bilk you out of thousands.

18. Create a blog or YouTube channel

Are you an expert on travel to Thailand? A maven of Minecraft? A sultan of swing dancing? Take your passion for a subject and turn it into a blog or a YouTube channel, using ads or sponsors to generate income.

Find a popular subject, even a small niche, and become an expert. At first, you’ll have to build out a suite of content and draw an audience, but it can create a steady income stream over time as you become known for your engaging content.

Opportunity: You can leverage a free (or very low-cost) platform and then use your great content to build a following. The more unique your voice or area of interest, the better for you to become “the” person to follow. Then, draw sponsors to you.

Risk: You’ll have to build out content at the start and then create ongoing content, which can take time. You’ll need to be passionate about the product since that can help you maintain the motivation to continue, especially at the start, as your followers are still finding you.

The downside is that you can outlay your time and resources with little to show for it if there’s limited interest in your subject or niche. Your area of expertise may be to niche to draw a profitable audience, but you won’t be sure of that until you experiment.

19. Rent out valuable household items

Here’s a variation on renting out an idle car: Start even smaller with other household items that people may need but may be collecting dust in your garage. Lawnmowers? Power tools? Mechanics tools and toolbox? Tents or large coolers?

Look for high-value items that people need for a short period and where it might not make sense for someone to own them. Then, put together a way for clients to discover your inventory and a way for them to pay for it.

Opportunity: You can start small here and then scale up if interested in a particular area. Do people suddenly want a tent for weekend camping when the weather gets warmer or more relaxed? Figure out where the demand is, and then you could buy the item rather than have it on hand. Sometimes, you recoup the item’s value after a few uses.

Risk: There’s always the possibility that your property is damaged or stolen, but you can mitigate this risk with contracts that allow you to replace the item at the client’s expense. If you start small here, you’re not exposed to many risks, especially if you already have the item and you’re not likely to need it shortly.

Pay particular attention to liability issues, especially if you’re renting out potentially dangerous equipment (e.g., power tools.)

20. Sell designs online

If you have design skills, you can turn them into a money maker by selling items with printed designs. Businesses such as CafePress and Zazzle allow you to sell items such as T-shirts, hats, mugs, and more with your designs.

Opportunity: You can start with your designs, see what the market is interested in, and expand from there. You can capitalize on the surging interest in a current event and design a shirt that captures the spirit of the times or at least a snarky take on it. And you can also set up your web storefront through a site such as Shopify to market your goodies.

Risk: Printing partners allow you to ship items without directly investing in the merchandise, avoiding one of the most significant risks of tying up your capital. But you can get better pricing if you invest in some inventory.

Another significant risk is that you could invest a lot of time with little payoff. Still, this avenue might be interesting if you’re already doing the design work for another purpose, such as personal interest.

Which Passive Income Source Is The Best?

The question of which passive income source is best depends on several factors. Still, some of the most important include the amount of money you have to invest, the total opportunity size, your interest and ability in the area, the amount of time you need to invest, and the potential to succeed.

Typically, the lower the barriers to entry, the more crowded the field of competitors and the lower the likelihood of success.

So, you’ll need to weigh the opportunity against these factors and see which passive income strategy works best for you. However, it can be helpful to have a natural ability and an interest in your target area because these can help motivate you in the early days when things are likely to be more challenging.

There are passive income opportunities for people starting with some money and even those with no money to start.

How Can I Make Passive Income With No Money?

If you have little or no money to start, you’ll have to rely mostly on your time investment to power you through, at least until you build up a little money. That means focusing on passive income sources that take advantage of the following traits:

- An area where you’re an expert. Here, you can build your expertise into a valuable product or service for consumers, e.g., design, software coding, and others.

- An upfront work-heavy opportunity. You’ll need an opportunity that requires a time or work investment, such as creating a course, building an influencer profile, or other options.

In effect, you’re substituting your time for your lack of capital until you can get enough capital to expand your opportunities.

How can I make passive income with money?

Money can provide you with more passive investment opportunities. If you have money to invest in a passive opportunity, you have the opportunity set above and a new range, too. Money is a prerequisite for taking advantage of the following passive income areas:

- Investing in dividend stocks or REITs. Investing in stocks means you need money upfront, but you’ll receive some of the most passive forms of income around.

- Save with bonds or CDs. Other purely passive activities include buying bonds or CDs.

Here, you can use your money to make money with little or no effort if that’s what you’d like to do. Of course, you could also pair your money with a lot of time investment to move into an even more lucrative niche.

How Many Income Streams Should You Have?

There is no “one size fits all” advice regarding generating income streams. How many sources of income you have should depend on where you are financially and your financial goals for the future. But having at least a few is a good start.

“You’ll catch more fish with multiple lines in the water,” says Greg McBride, CFA, chief financial analyst at Bankrate. “In addition to the earned income generated from your human capital, rental properties, income-producing securities and business ventures are a great way to diversify your income stream.”

Of course, you’ll want to ensure that putting effort into a new passive income stream isn’t causing you to lose focus on your other streams. So, you want to balance your efforts and choose the best opportunities for your time.

Passive Income Ideas For Beginners

- High-yield savings account. A high-yield savings account can easily boost your savings beyond what you’d receive in a typical checking or savings account. It won’t be much, but it’s a simple way to start with passive income.

- Certificates of deposit. CDs are another way to generate some passive income, but your money will be tied up more than it would be in a high-yield savings account.

- Real estate investment trusts. REITs are a way to invest in real estate without putting in all the effort that comes with managing properties. REITs typically pay out most of their income in dividends, making them an attractive option for investors looking for passive income.

Minimize your taxes on passive income

A passive income can be an excellent strategy for generating side income, but you’ll also generate a tax liability for your effort. But you can also reduce the tax bite and prepare for your future by setting yourself up as a business and creating a retirement account. However, this strategy won’t work for all these passive strategies, and you’ll have to be a legitimate business to qualify.

- Register with the IRS and receive a tax identification number for your business.

- Then contact a broker who can open a self-employed retirement account, such as Charles Schwab or Fidelity.

- Determine which kind of retirement account might work best for your needs.

The solo 401(k) and the SEP IRA are popular options. If you stash the cash in a traditional 401(k) or SEP IRA, you can take a tax break on this year’s taxes. The solo 401(k) is great because you can stash up to 100 percent of your earnings into the account, up to the annual maximum.

Meanwhile, the SEP IRA allows you to contribute only at a 25 percent rate. In addition, the solo 401(k) permits you to contribute up to 25 percent of your profits in the business.

If you’re thinking of going this route, compare the differences between the two account types or look at the best retirement plans for the self-employed.

Conclusion: There’s a Passive Income Stream Out There for You

The world of passive income is vast and ever-evolving. With a little creativity and dedication, you can find an option that aligns with your skills and interests. Remember, most passive income streams require some upfront effort, but the long-term benefits can be significant. So, explore your options, choose an idea that excites you, and get started on your journey to financial freedom!

Discover more from Digital Wealth Guru

Subscribe to get the latest posts sent to your email.

[…] Online business ideas: People may be interested in learning about online business models, such as e-commerce, SaaS, or affiliate marketing, and how to get started. […]

[…] stocks, or through creating and selling digital products, such as online courses or ebooks. Passive income can be an appealing option for people who want to earn money without trading their time for it, and it can also be a way to […]

[…] option I explored was affiliate marketing. Affiliate marketing involves promoting someone else’s product or service and earning a […]