Have you ever had $100 in your pocket and wondered how you could turn it into $1,000, $10,000, or even $100,000? Unfortunately, investing isn’t something they teach in school, which can make it seem daunting for beginners. But don’t worry—I’m here to simplify the process.

Investing allowed me to become a multimillionaire, and I started with just $100 (actually, it was probably even less than that). While becoming rich isn’t easy, taking calculated risks can help grow your wealth over time.

“How to Invest” is usually a big challenge for young people who intend to start building their investment portfolio. In this post, we’ll explore how to invest $100 as a beginner, with each investment option increasing in risk but also in potential reward.

What is Investing?

Investing is the strategic allocation of assets with the expectation of generating a return over time. It’s a fundamental component of building wealth and achieving long-term financial goals.

How Investing Works:

- Asset acquisition: Investors purchase stocks, bonds, real estate, or commodities.

- Value appreciation: The core principle is that the value of these assets will increase over time.

- Income generation: Many investments provide regular income, like stock dividends or rental income from property.

Why invest?

- Beat inflation: Historically, the return on investments has outpaced inflation, preserving purchasing power.

- Compounding returns: Over time, the power of compounding can significantly boost investment growth.

- Financial goals: Investing is essential for achieving significant financial milestones, such as retirement, homeownership, or children’s education.

Investment vehicles:

- Stocks: Represent ownership in a company.

- Bonds: Essentially loans to governments or corporations.

- Real estate: Property ownership for rental income or appreciation.

- Mutual funds: Pooled investments managed by professionals.

- Exchange-traded funds (ETFs): Similar to mutual funds but traded on exchanges.

It’s crucial to remember that investing involves risk. The potential for higher returns often correlates with greater risk. To mitigate this, diversification across different asset classes is usually recommended.

How to Invest for Beginners Starting With Just $100

1. High-Interest Savings Account

Risk Level: 1/10

The first and simplest investment is a high-interest savings account. While finding a savings account with a substantial interest rate may be challenging nowadays, the main benefit is creating an emergency fund. This fund is crucial for unexpected expenses and helps you avoid debt.

When choosing a savings account, look for two key features: a good interest rate and the ability to access your money instantly. Some recommended banks include Ally Bank, Marcus by Goldman Sachs, and Citibank. For instance, Marcus offers an interest rate of 0.7%, among the best available, although not very high.

2. Gold

Risk Level: 2/10

Gold is often considered a “safe-haven” investment, especially during economic uncertainty. Since the creation of the Federal Reserve in 1913, the U.S. dollar has lost 95% of its value, making gold a good option for preserving purchasing power.

If you’d bought a $100 nugget of gold in 2000, it would now be worth around $580. There are two ways to invest in gold: buying physical gold or purchasing it through a broker app like Robinhood (USA) or Trading 212 (UK). While physical gold can have additional costs, investing through a broker allows for buying and selling at market value.

3. Index Funds

Risk Level: 3/10

Index funds are a great way to invest with minimal knowledge of the stock market. If you invested $100 per month into an index fund with a 7% annual return, after 30 years, you’d have $123,000. For example, the S&P 500 index fund includes companies like Apple, Microsoft, Amazon, and Facebook.

To maximize your returns and protect them from taxes, consider investing in a Roth IRA (USA) or an ISA (UK), which allows your money to grow tax-free. You don’t need to buy a full share to start investing; platforms like Fidelity, Charles Schwab, and Vanguard offer fractional shares.

4. Real Estate Investment Trusts (REITs)

Risk Level: 3/10

REITs allow you to invest in income-producing properties without actually buying real estate. They generate income through rent and are required by law to distribute 90% of profits to investors, similar to dividends.

REIT ETFs often outperform the S&P 500, with some offering average returns of 10% or more. In the USA, you can invest in the VGSLX by Vanguard; in the UK, you can use Trading 212 to invest in a diversified global REIT.

5. Buying and Selling Items

Risk Level: 4/10

If you’re interested in buying and selling items, you can start with something you’re passionate about and knowledgeable about, such as pre-owned electronics, collectibles, or sports equipment. The key is to find good deals and resell them for a profit.

For example, you can use platforms like Facebook Marketplace or eBay to buy and sell items. This method requires more effort and knowledge but can yield higher returns if done correctly.

6. Individual Stocks

Risk Level: 6.5/10

Investing in individual stocks involves more risk but also offers the potential for higher returns. I made significant gains during the dot-com boom by investing in well-researched companies. However, the stock market can be volatile, and it’s essential to conduct fundamental analysis—examining financial statements, market conditions, and company leadership—before investing.

You can use platforms like Yahoo! Finance for research and brokers like Webull, which currently offers free stocks when you deposit $100.

7. Cryptocurrency

Risk Level: 9/10

Cryptocurrencies like Bitcoin, Ethereum, and Ripple offer the potential for massive returns but are highly volatile and risky. For example, $100 invested in Bitcoin in 2015 could have grown to $5,000 by today.

However, it’s crucial to understand that cryptocurrencies are speculative and not regulated by governments, making them a high-risk investment. Only invest money you can afford to lose. Platforms like Coinbase allow you to buy and store cryptocurrencies securely.

8. Lottery

Risk Level: 10/10

Finally, there’s the lottery, which is essentially gambling. The odds of winning are extremely low—about one in 14 million—but many people still play in hopes of hitting the jackpot. While it can be fun to play occasionally, it’s not a recommended investment strategy, as you’re more likely to lose money.

Factors Preventing People From Investing

Several factors prevent people from investing despite its potential benefits. Understanding these barriers can help address them and encourage more people to start investing. Here are some common reasons:

1. Lack of Knowledge and Understanding

Many people find the financial world confusing due to its complexity. Terms like “dividends,” “capital gains,” and “asset allocation” can be overwhelming for beginners. The variety of investment options—from stocks and bonds to mutual funds and ETFs—can create confusion.

Solutions:

- Educational Resources: Utilize online platforms, books, podcasts, and webinars that simplify investing concepts. Websites like Investopedia or platforms like Khan Academy offer free resources.

- Courses and Workshops: Enroll in beginner-friendly financial literacy courses offered by community centers, online platforms, or educational institutions.

- Start with Basics: Begin with simple investments, such as index funds or ETFs, which are generally easier to understand and manage.

2. Fear of Risk and Loss

Investing inherently involves risk, and the possibility of losing money can be daunting. Media reports of market downturns or personal anecdotes of failed investments can amplify this fear.

Solutions:

- Diversification: Spread investments across different asset classes to reduce risk. Diversification helps mitigate the impact of poor performance in any single investment.

- Education on Risk Management: Learn about different types of risk and strategies to manage them, such as setting stop-loss orders or investing in lower-risk assets.

- Start Small: Begin with lower-risk investments to gain confidence before moving into more volatile options.

3. Insufficient Funds

There is a common misconception that substantial capital is required to start investing. This belief can prevent individuals from exploring investment opportunities with smaller amounts of money.

Solutions:

- Fractional Shares: Many brokerages offer fractional shares, allowing you to invest in expensive stocks with little money.

- Robo-Advisors: Platforms like Betterment or Wealthfront provide automated investment services with low minimum investments and low fees.

- Micro-Investing Apps: Apps like Acorns or Stash allow you to invest spare change from everyday purchases.

4. Lack of Time

Investing requires research and monitoring, which can be challenging for individuals with busy schedules. The perception of investing as a time-consuming activity can be a deterrent.

Solutions:

- Automated Investing: Use robo-advisors or set up automatic contributions to investment accounts to minimize the need for active management.

- Simplified Investment Options: Opt for low-maintenance investments such as index funds or ETFs that require less frequent oversight.

- Dedicated Time Blocks: Set aside specific times for financial review and investment planning to make it more manageable.

5. Fear of Making Mistakes

The fear of making poor investment decisions can be paralyzing. The potential financial consequences of mistakes often compound this fear.

Solutions:

- Start with Simulations: Practice using investment simulators or virtual trading platforms without risking real money.

- Seek Professional Advice: Consult with a financial advisor or mentor to guide you through the investment process and provide reassurance.

- Educate Yourself Continuously: Ongoing learning helps build confidence and reduce the likelihood of making uninformed decisions.

6. Lack of Trust

Skepticism about financial institutions and advisors can stem from concerns about scams, fraud, or conflicts of interest. Negative experiences or stories about financial misconduct can further erode trust.

Solutions:

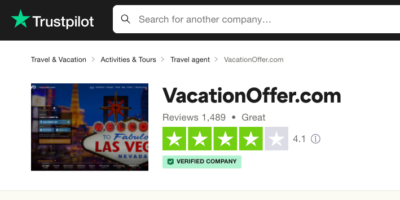

- Research and Reviews: Investigate the reputation of financial advisors and institutions through reviews, regulatory filings, and independent ratings.

- Certified Advisors: Seek out advisors with recognized certifications (e.g., CFP, CFA) who adhere to ethical standards and fiduciary responsibilities.

- Transparent Platforms: Use well-known and transparent investment platforms that provide clear information about fees and services.

7. Economic Uncertainty

Economic instability, such as recessions or inflation, can make people hesitant to invest. Uncertain financial environments can lead to a preference for safer, more liquid assets like cash.

Solutions:

- Emergency Fund: Maintain an emergency fund to cover unexpected expenses, allowing you to invest with greater peace of mind.

- Diversify Investments: Diversify across asset classes and geographic regions to hedge against economic uncertainty.

- Long-Term Perspective: Focus on long-term investment goals rather than short-term market fluctuations.

8. Cultural and Social Factors

Cultural attitudes towards money and investing can vary. In some cultures, there may be a stronger emphasis on saving than investing or a lack of focus on financial education.

Solutions:

- Family Education: Encourage open discussions about money and investing within families to build a culture of financial literacy.

- Community Programs: Participate in community programs or organizations that promote financial education and investing awareness.

- Cultural Adaptation: Seek investment strategies and resources that align with your cultural and personal values.

9. Previous Negative Experiences

Negative experiences, such as significant losses or poor financial advice, can create a reluctance to invest again. These experiences can leave lasting impressions that deter future investments.

Solutions:

- Learn from Mistakes: Analyze past mistakes to understand what went wrong and avoid repeating the same errors.

- Gradual Reentry: Start with less risky investments or smaller amounts to rebuild confidence and experience.

- Consult Professionals: Work with financial advisors to develop a tailored investment strategy that addresses past concerns.

10. Complexity of Financial Products

The wide range of financial products and investment vehicles can be confusing, making it difficult for individuals to select the right options for their goals and risk tolerance.

Solutions:

- Focus on Simplicity: Begin with straightforward investments, such as index funds or savings bonds, before exploring more complex products.

- Use Comparisons: Utilize comparison tools and resources to understand the differences between various financial products.

- Professional Guidance: Seek advice from financial professionals to help navigate the complexity of investment options.

11. Regulatory and Tax Concerns

Regulatory changes and tax implications can be complex and vary by region. Concerns about how investments are taxed or the legal requirements can deter people from investing.

Solutions:

- Stay Informed: Keep up-to-date with changes in regulations and tax laws through reliable sources and financial news.

- Tax-Advantaged Accounts: Utilize tax-advantaged investment accounts, such as IRAs or ISAs, to optimize tax benefits.

- Consult Tax Professionals: Work with tax advisors to understand the tax implications of your investments and develop a tax-efficient strategy.

12. Psychological Barriers

Psychological factors like procrastination or low self-confidence can prevent people from taking action. Emotional attitudes towards money and investing play a significant role.

Solutions:

- Set Goals: Establish clear and achievable financial goals to motivate action and provide direction.

- Create a Plan: Develop a structured investment plan with specific steps and deadlines to overcome procrastination.

- Seek Support: Engage with investment communities or mentors who can provide encouragement and accountability.

By comprehensively addressing these factors, individuals can better navigate the challenges of investing and work towards achieving their financial goals.

Conclusion: How to Invest for Beginners (Start with Just $100)

Investing can be an excellent way to grow your wealth, even if you start with just $100. Remember, the key is to take calculated risks and choose investments that align with your financial goals and risk tolerance.

Whether you opt for a low-risk savings account or dive into the world of cryptocurrencies, the most important step is to start. If you’d like to see how these investments perform over time, let me know in the comments, and consider subscribing to stay updated on future posts. Happy investing!

Discover more from Digital Wealth Guru

Subscribe to get the latest posts sent to your email.

Comments