Financial Freedom Hacked! The Simple Path to Wealth Anyone Can Follow to Escape the paycheck-to-paycheck cycle & gain financial freedom!

Explore the unconventional, yet potent, secrets of true wealth creation laid out in our practical guide.

We often perceive wealth through the lens of financial prosperity, measuring it in digits on a bank statement or the accumulation of material possessions.

However, my journey toward understanding the genuine meaning of wealth took me far beyond these monetary confines.

The True Meaning of Wealth

In my early years, the notion of wealth was synonymous with grandeur – large houses, luxurious cars, and extravagant vacations. It was a perspective shaped by societal norms and the prevailing narrative that equated success with a hefty bank balance.

Little did I realize that my initial perception of wealth was a narrow and one-dimensional view, akin to observing a vast landscape through a keyhole.

One defining moment challenged this perspective, an epiphany that would reshape the trajectory of my life. It wasn’t an extravagant event or a sudden windfall, but a simple realization that wealth extends beyond the tangible and material.

It encompasses the richness of experiences, the depth of relationships, and the overall well-being that transcends the boundaries of currency.

Allow me to take you on a journey through the evolution of my understanding of wealth, where personal anecdotes and reflections serve as signposts on the path to a more holistic and meaningful abundance.

The Foundation of Wealth

Building wealth is akin to constructing a sturdy structure; it requires a strong foundation to withstand the tests of time and circumstance.

In this section, I delve into the crucial importance of a robust financial foundation and share personal anecdotes that illuminate the transformative power of budgeting and saving.

The Cornerstones of Stability

A solid financial foundation serves as the bedrock of one’s economic well-being. It’s the difference between navigating through financial storms with confidence or facing the risk of collapse.

My journey began with recognizing the significance of a well-constructed financial base – an understanding that would prove instrumental in shaping my approach to wealth building.

The Budgeting Odyssey

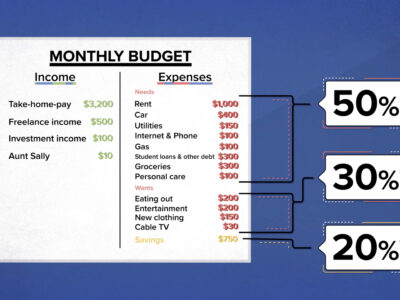

Budgeting, often seen as a restrictive practice, emerged as a liberating tool on my path to financial stability. I share personal experiences of crafting and refining budgets, demystifying the process by illustrating how it became a roadmap for my financial journey.

From distinguishing needs and wants to making informed spending decisions, budgeting became the compass guiding me toward fiscal responsibility.

The Art of Saving

Saving, a seemingly simple concept, unfolds as a nuanced art in the wealth building narrative. I recount my experiences with saving – the initial challenges, the discipline cultivated over time, and the tangible rewards it brought.

From the satisfaction of watching a savings account grow to the security it provided during unforeseen circumstances, the act of saving became a cornerstone in fortifying my financial foundation.

Navigating Peaks and Valleys

Budgeting and saving are not static practices but dynamic processes that evolve with life’s twists and turns. In this section, I share personal stories of navigating financial peaks and valleys, demonstrating the resilience ingrained in a solid financial foundation.

From unexpected expenses to career changes, these experiences underscore the adaptability required to maintain the integrity of one’s economic groundwork.

As we traverse through the pages of my financial journey, the essence of this section lies in recognizing that a robust financial foundation is not merely about numbers; it’s a dynamic interplay of disciplined budgeting, mindful saving, and the adaptability to weather life’s uncertainties. Stay tuned as we move forward on the simple path to wealth.

Investing 101

Venturing into the realm of investing is akin to discovering the alchemy of wealth growth. In this section, we unravel the basics of investing and the transformative power of compounding.

Join me as I share the enlightening moments and lessons from my journey in understanding the intricate world of investment vehicles.

The Essence of Investing

Investing is not merely about allocating money; it’s a strategic decision to make your money work for you. I delve into the fundamental principles of investing, emphasizing the distinction between saving and investing.

Understanding the purpose of investing laid the groundwork for my journey, serving as the catalyst for future financial growth.

The Compounding Miracle

Compounding, often hailed as the eighth wonder of the world, is a magical force that amplifies wealth over time. In this section, we explore the mathematics behind compounding and its exponential impact on investments.

My own revelations about the compounding phenomenon transformed my perspective, turning patience into a virtue and emphasizing the long-term nature of successful investing.

Navigating Investment Vehicles

Embarking on the journey of understanding investment vehicles can be both exciting and intimidating. From stocks and bonds to mutual funds and real estate, each vehicle has its unique characteristics.

Mistakes were made, lessons were learned, and the journey towards investment literacy unfolded as a tapestry of experiences.

The Emotional Rollercoaster

Investing is not just about numbers and strategies; it’s a journey laden with emotions. I reflect on the emotional rollercoaster that comes with market fluctuations, the thrill of successful investments, and the resilience required during downturns.

Understanding the psychological aspects of investing became an integral part of my journey, shaping a more balanced and informed approach to wealth accumulation.

As we delve into Investing 101, remember that the journey is as significant as the destination.

The basics of investing and the wonders of compounding are not reserved for financial experts; they are accessible to anyone willing to embark on this enlightening voyage. Stay tuned as we navigate the complexities and unravel the secrets of the simple path to wealth.

The Power of Simplicity

In the labyrinth of financial intricacies, simplicity emerges as a guiding light. This section champions the merits of a straightforward and uncomplicated approach to finance.

Join me as I advocate for the transformative power of simplicity and share personal stories that illuminate the profound impact of simplifying my own financial life.

The Complexity Conundrum

The financial world often appears shrouded in complexity, intimidating those seeking to navigate its intricacies. In this section, we explore the paradox of simplicity in finance, highlighting the benefits of avoiding unnecessary complexity.

My journey unfolded against a backdrop of simplifying financial principles, revealing that clarity and understanding can be found in simplicity.

The Liberation of Minimalism

Minimalism isn’t merely an aesthetic choice; it’s a philosophy that extends to one’s financial life. I share personal anecdotes of embracing a minimalist approach, decluttering not only physical spaces but also financial obligations.

The liberation found in shedding the excess, be it possessions or financial commitments, underscores the transformative power of embracing simplicity.

Streamlining Financial Systems

Complex financial systems can be overwhelming, leading to confusion and, at times, costly mistakes. This section delves into my experiences of streamlining financial systems, from consolidating accounts to automating processes.

The shift towards simplicity not only reduced stress but also freed up mental space for more strategic financial decisions.

Prioritizing Financial Well-being

Amidst the noise of financial advice, simplicity allows for a clear focus on what truly matters. I recount personal stories of prioritizing financial well-being by simplifying goals and aligning them with core values.

The process involved shedding unnecessary financial commitments, allowing for a more intentional and mindful approach to wealth accumulation.

Simplicity is not a compromise; it’s a conscious choice that empowers individuals to take control of their financial destinies.

As we explore the transformative power of simplicity, let these personal narratives serve as beacons, illuminating the path towards a clearer, more intentional, and ultimately, more prosperous financial life. Stay tuned as we continue our journey on the simple path to wealth.

Embracing Frugality – The Art of Thriftiness in Wealth Accumulation

Frugality, often misunderstood as deprivation, emerges as a silent ally on the journey to wealth-building. In this section, we explore the profound impact of frugal living and delve into practical tips for embracing a thrifty lifestyle.

Join me as I share the transformative effects of consciously choosing a simpler, more intentional approach to expenses.

The Frugality Paradigm

Frugality is not about penny-pinching or a meager existence; it’s a deliberate choice to maximize value and minimize waste. This section delves into the paradigm shift that occurred when I embraced frugality.

The realization that every expense is a trade-off between immediate gratification and long-term financial goals became a cornerstone in my wealth-building journey.

Mindful Spending Habits

Frugal living is rooted in mindful spending habits. I share personal anecdotes of recalibrating my relationship with money – distinguishing between needs and wants, understanding the true cost of purchases, and avoiding impulse spending.

The practice of mindfulness in financial decisions became a powerful tool in channeling resources towards meaningful wealth building endeavors.

The Liberation of Minimalism

Minimalism and frugality intertwine as allies on the path to wealth. Building on the earlier exploration of minimalism, this section delves into the liberation found in embracing a minimalist, frugal lifestyle.

The freedom from the shackles of consumerism and the conscious rejection of societal pressures to accumulate material possessions became transformative aspects of my wealth-building journey.

The Compound Effect of Small Savings

Frugal living operates on the principle of small, consistent savings having a compound effect over time. These seemingly small actions, when compounded over the months and years, contribute significantly to the overall financial landscape.

As we navigate the terrain of frugality, let it be understood that embracing thriftiness is not about deprivation but rather a mindful choice to allocate resources where they matter most.

Through personal stories and practical insights, this section sheds light on the symbiotic relationship between frugality and wealth-building, paving the way for a more intentional and prosperous financial future. Stay tuned as we continue unraveling the secrets of the simple path to wealth.

Mindset Matters – The Psychology Behind Wealth Building

In the journey to wealth building, the terrain of the mind is as crucial as financial strategies. This section delves into the psychological aspects of wealth building, unraveling the intricate dance between mindset and financial success.

The Power of Abundance Mindset

The mindset of abundance is a magnetic force that attracts wealth. I explore the concept of an abundance mindset, recounting my journey from a scarcity mentality to embracing abundance.

This shift opened my eyes to opportunities, fostering a positive outlook that became a driving force in wealth creation.

Overcoming Limiting Beliefs

Limiting beliefs act as invisible barriers to financial success. Whether rooted in childhood conditioning or societal expectations, overcoming these mental barriers was a transformative step towards unlocking my full financial potential.

Resilience in the Face of Setbacks

Instant gratification often clashes with the patient nature of wealth-building. I share insights into cultivating a long-term perspective, emphasizing the importance of delayed gratification. This shift in mindset allowed me to resist impulsive financial decisions and stay focused on the enduring goals that form the foundation of sustained wealth.

The journey to wealth is not without its setbacks, and resilience becomes a currency of its own. I reflect on personal stories of financial challenges, from market downturns to unexpected expenses. The ability to bounce back from setbacks, coupled with a resilient mindset, became a defining factor in navigating the inevitable uncertainties on the path to wealth.

Cultivating a Long-Term Perspective

As we explore the psychological nuances of wealth-building, let these personal mindset shifts serve as guiding lights. The mind is a powerful ally or adversary in the pursuit of wealth, and understanding its intricacies can be as impactful as any financial strategy. Stay tuned as we continue navigating the mental landscape on the simple path to wealth.

Financial Independence Retire Early (FIRE)

In the pursuit of financial autonomy, the FIRE movement emerges as a beacon of inspiration. This section introduces the FIRE movement and its principles, shedding light on the transformative journey towards financial independence.

The Essence of FIRE

Financial Independence Retire Early (FIRE) is more than an acronym; it’s a philosophy that challenges conventional notions of retirement. I delve into the core principles of FIRE, emphasizing the pursuit of financial freedom that enables individuals to retire on their terms, often far earlier than traditional retirement ages.

The Power of Aggressive Saving

Aggressive saving is a cornerstone of the FIRE movement. I share personal stories of adopting a high savings rate, redirecting a significant portion of income towards investments. The discipline of living below my means and funneling resources into wealth-building endeavors became a powerful engine propelling me towards financial independence.

Mindful Spending and Lifestyle Design

FIRE is not about austerity; it’s about intentional living. This section explores the principles of mindful spending and lifestyle design within the FIRE framework. Personal anecdotes reveal how aligning spending with values and designing a life centered around passions contributed to a fulfilling journey on the path to financial independence.

Navigating Challenges on the FIRE Trail

While the FIRE movement offers a roadmap to financial freedom, it’s not without challenges. I share insights into navigating obstacles, from market uncertainties to adjusting lifestyle expectations. The flexibility inherent in the FIRE philosophy allowed me to adapt to changing circumstances while staying true to the overarching goal of achieving financial independence.

The Liberation of Financial Independence

Reaching financial independence is not just a numerical milestone; it’s a profound liberation. I share personal reflections on the emotional and psychological aspects of achieving financial independence, from the moment of realization to the newfound sense of control and autonomy over life choices.

As we explore the principles and personal journey within the FIRE movement, let it be a testament to the transformative potential of intentional living and financial discipline. The flames of financial freedom are not exclusive; they can be ignited by anyone willing to embrace the principles of FIRE. Stay tuned as we continue unveiling the secrets of the simple path to wealth.

Navigating Challenges – Triumphs in the Face of Adversity

The path to wealth is riddled with challenges, and acknowledging them is an integral part of the journey. In this section, we confront the obstacles faced on the path to wealth and delve into personal stories of overcoming financial setbacks. Join me as we navigate the trials that test the resilience of the simple path to wealth.

Acknowledging Financial Storms

Every journey has its storms, and the path to wealth is no exception. I acknowledge the financial challenges encountered – from economic downturns to unexpected expenses. The first step in overcoming these obstacles is acknowledging their presence and understanding their potential impact on the broader financial landscape.

The Ebb and Flow of Market Volatility

Market volatility is an inherent aspect of wealth-building. Understanding the cyclical nature of markets and maintaining a long-term perspective became essential in weathering the storm of market uncertainties.

Adjusting Financial Sail in Career Storms

Career storms can disrupt the financial journey, whether through job loss, career transitions, or unexpected twists. I reflect on personal experiences of adjusting financial sails during career storms, emphasizing the importance of adaptability and strategic planning in maintaining financial stability amidst professional changes.

The Unexpected Expense Curveball

Life often throws unexpected expenses our way. The ability to adapt and navigate these unexpected expenses without derailing long-term financial goals underscores the resilience ingrained in the wealth-building journey.

Turning Setbacks into Comebacks

Triumph emerges not in the absence of setbacks but in the ability to turn them into comebacks. From learning valuable lessons to implementing strategic changes, each setback became a stepping stone towards a more robust financial future.

As we navigate the challenges inherent in the pursuit of wealth, let these stories serve as a testament to the resilience and adaptability required on the simple path to wealth.

Acknowledging challenges is not a sign of weakness but a testament to the strength gained through overcoming them. Stay tuned as we conclude our exploration, armed with the wisdom gained from triumphs in the face of adversity on the simple path to wealth.

The Simple Path to Wealth Review

J.L. Collins’ “The Simple Path to Wealth” has established itself as a cornerstone for many seeking to navigate the often-daunting world of long-term wealth creation.

Its central message revolves around a straightforward approach: prioritize low-cost, total stock market index funds, embrace a patient and disciplined strategy, and minimize fees while living below your means.

But is this “simple path” truly paved with gold, or are there potential bumps along the road?

Unpacking the Strengths in The Simple Path to Wealth Pdf:

- Accessibility for All: The book’s strength lies in its ability to demystify complex financial concepts through clear language and relatable anecdotes. Unlike many finance books that drown readers in jargon, Collins employs a conversational style, making the text engaging and approachable even for beginners.

- The Power of Simplicity: By advocating for a single-fund approach focused on total stock market indexes, Collins cuts through the noise of countless investment options and emphasizes the power of long-term, consistent contributions. This resonates with individuals seeking a streamlined and less time-intensive approach to building wealth.

- Data-Driven Persuasion: The book doesn’t simply preach; it backs its claims with historical data and performance comparisons. By showcasing the historical outperformance of index funds against actively managed portfolios over the long term, Collins provides evidence to support his core message.

Potential Points of Divergence in The Simple Path to Wealth Audiobook:

- One Size Fits (Some)? While the simplicity of the approach has undeniable appeal, critics argue that it might oversimplify investment strategies and fail to fully address the nuances of individual financial situations and risk tolerances. Different life stages, risk profiles, and financial goals might necessitate adjustments beyond the one-fund approach.

- Beyond the Borders: “The Simple Path to Wealth” heavily focuses on the US stock market, offering valuable insights for US investors. However, its direct applicability to other countries with distinct financial landscapes and regulations might be limited.

- Asset Allocation Nuances: The book’s primary focus on stocks, while effective for long-term growth, might seem narrow to some investors seeking a more diversified portfolio incorporating asset classes like bonds or real estate.

Navigating the Path: Making Informed Choices

“The Simple Path to Wealth book” undoubtedly offers a valuable framework for long-term investment, particularly for beginners seeking a clear and actionable approach. Its emphasis on low-cost index funds, discipline, and responsible financial habits resonates with many investors. However, it’s crucial to remember that personal circumstances play a significant role. Before making any investment decisions based on this book, consider the following:

- Individuality Matters: Your financial goals, risk tolerance, and overall financial situation should be guiding factors in your investment decisions. While the book provides a solid foundation, consulting with a financial advisor who can tailor a strategy to your specific needs is highly recommended.

- Beyond the Hype: The book has garnered a loyal following and positive testimonials, but remember that past performance is not necessarily indicative of future results. Conduct your own research, stay informed about market trends, and avoid blindly following any single investment strategy.

- Continuous Learning: As your financial landscape evolves, so should your investment strategy. Remain adaptable and keep learning about financial concepts and investment options to make informed decisions throughout your financial journey.

Ultimately, whether “The Simple Path to Wealth” is the right path for you depends on your individual circumstances and financial goals. By carefully considering its strengths and limitations, conducting your own research, and seeking professional guidance when needed, you can pave your own path towards achieving financial security and peace of mind.

The Simple Path to Wealth Summary

The journey to wealth involves budgeting and saving as the foundation, investing wisely with the magic of compounding, embracing simplicity in financial choices, fostering a positive mindset, understanding the FIRE movement for financial independence, and triumphing over challenges with resilience.

Reflecting on this journey, it’s not just about the numbers but transforming our mindset, lifestyle, and purpose, finding wealth in a holistic sense. The path is a flexible guide, inviting intentional financial choices for a fulfilling life.

Discover more from Digital Wealth Guru

Subscribe to get the latest posts sent to your email.

Comments