what is Crypto Lending for Profit? – As someone who has been involved in the world of cryptocurrency for several years now, I have seen firsthand the incredible potential that this emerging technology has for revolutionizing the way we think about money and financial transactions.

One of the most exciting developments in recent years has been the rise of crypto lending platforms, which allow users to earn interest on their cryptocurrency holdings simply by lending them out to others.

In this blog post, I will share my personal experiences with crypto lending and offer tips and insights for anyone who is interested in exploring this exciting new world of finance.

Introduction To Crypto Lending

One of the main benefits of cryptocurrencies is that it is decentralized. The cryptocurrency industry has coined the term “decentralized finance” (DeFi) to refer to the expanding industry of blockchain-based financial services.

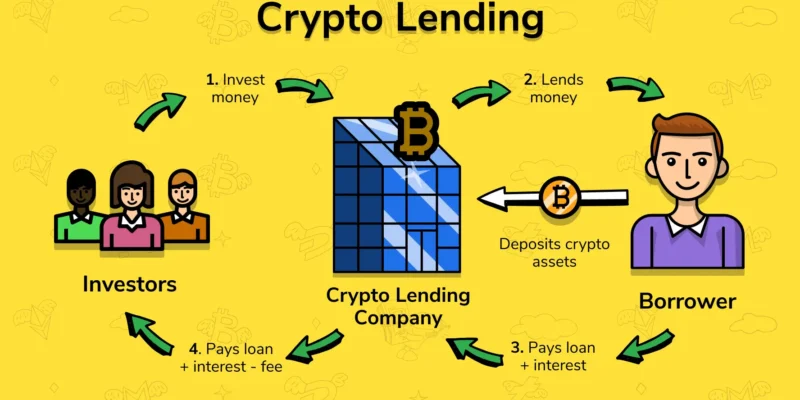

Many cryptocurrency exchanges and other cryptocurrency platforms now feature borrowing and lending services, making crypto lending one of the most popular and widely used DeFi services. The website accepts cryptocurrency deposits from investors and lends them out to borrowers who pay interest in return.

What Is Crypto Lending?

In the decentralized financial service known as crypto lending, investors can make loans to borrowers using their cryptocurrency holdings. The interest that is paid to the lender in cryptocurrency is similar to the interest that would be paid on a savings account.

Lenders on cryptocurrency lending platforms, whether centralized or decentralized, may be able to earn annual percentage yields (APYs) of 15% or more, depending on the platform and other conditions.

Loans secured by a borrower’s crypto holdings are made possible through online lending platforms.

Lenders and borrowers can both benefit from crypto lending, but the significant risks associated with the industry have been highlighted by recent market upheaval.

The Basics of Crypto Lending

Before diving into my personal experiences with crypto lending, it’s important to understand some of the basics of how these platforms work. At their core, crypto lending platforms allow users to lend out their cryptocurrency holdings to other users who are interested in borrowing them.

In exchange for lending out their funds, lenders are paid a certain amount of interest on a regular basis. Borrowers, in turn, are able to access the funds they need without having to sell off their own cryptocurrency holdings.

How Does Crypto Lending Work?

Platforms for cryptocurrency lending serve as mediators between investors and those seeking to borrow cryptocurrency. Investors put their cryptocurrency into high-interest lending accounts, and platform users can then take out loans using their cryptocurrency holdings as collateral. The cryptocurrency placed by lenders is used to finance loans on these platforms.

The platform determines the lending and borrowing interest rates, which gives it command over its net interest margins.

Crypto Lending Rates

The interest rates offered by each service and each cryptocurrency are unique. Fees for the platform’s use are possible, and some may reward lenders who are ready to keep their cryptocurrency locked up for an extended period of time with a higher interest rate.

Trusting a firm or other body to manage and enable the lending and borrowing of cryptocurrency is centralization. Accounts can be created by borrowers and lenders, and loan requests can be submitted by borrowers.

Crypto Lending Protocol

A decentralized crypto lending protocol allows lenders and borrowers to link their cryptocurrency wallets to a system that automates the loan and borrowing procedures through the use of smart contracts.

When specific circumstances are met, blockchain networks execute a piece of code known as a smart contract.

Crypto Lending Platform

There are a number of different crypto lending platforms available on the market today, each with its own unique features and benefits.

Some of the most popular platforms include Fintoch, Celsius Network, BlockFi, Nexo, and Bitfinex. Each of these platforms operates slightly differently, but the basic idea is the same: users lend out their cryptocurrency holdings and earn interest in return.

My Experience with Crypto Lending

Personally, I have had a lot of success with crypto lending over the past few years. When I first started investing in cryptocurrency, I was primarily focused on buying and holding assets like Bitcoin and Ethereum. However, as I learned more about the various opportunities available in the crypto space, I began to explore other options for generating passive income.

Crypto Lending for Profit

One of the first crypto lending platforms I experimented with was Celsius Network. I was drawn to Celsius because of its reputation for offering some of the highest interest rates in the industry.

I decided to start by lending out a small portion of my Bitcoin holdings and was pleasantly surprised by the results. Within just a few weeks, I had already earned a significant amount of interest on my investment.

Over time, I began to allocate more and more of my cryptocurrency holdings to lending platforms like Celsius. I found that this was an excellent way to generate passive income without having to actively trade or monitor the markets. Instead, I was able to sit back and watch as my investments grew steadily over time.

Crypto Lending Risk

Of course, crypto lending is not without its risks. Like any investment, there is always the possibility of losing money. However, I found that by sticking with reputable platforms and diversifying my investments across multiple platforms, I was able to minimize my risk while still earning significant returns.

Tips for Successful Crypto Lending

Based on my experiences with crypto lending, here are a few tips that I would offer to anyone who is interested in exploring this exciting new world of finance:

- Do your research: Before investing in any crypto lending platform, it’s important to do your due diligence and research the platform thoroughly. Look for reviews from other users, check out the platform’s security features, and make sure you understand how the platform generates returns.

- Diversify your investments: Just as with any other type of investment, it’s important to diversify your holdings across multiple platforms. This will help to minimize your risk and ensure that you are not overly reliant on any single platform.

- Start small: If you’re new to crypto lending, it’s a good idea to start with a small investment and gradually increase your holdings over time. This will help you to get a feel for how the platform works and how much you can realistically expect to earn.

- Stay up-to-date: The world of crypto lending is constantly evolving, with new platforms and innovations being introduced all the time. To be successful in this space, it’s important to stay up-to-date with the latest developments and trends. Follow industry news and stay engaged with other members of the crypto community to learn about new opportunities and potential risks.

- Consider tax implications: It’s important to understand the tax implications of crypto lending before getting started. Depending on where you live, you may be subject to capital gains taxes on your earnings, so be sure to consult with a tax professional to understand your obligations.

- Be prepared for volatility: Cryptocurrency markets are notoriously volatile, and the same is true of crypto lending platforms. While you can earn significant returns through lending, there is always the possibility that the value of your holdings could decrease. Be prepared for fluctuations in the market and be ready to adjust your strategy accordingly.

- Take security seriously: Finally, it’s important to take security seriously when investing in cryptocurrency. Make sure that you use strong passwords and two-factor authentication to protect your accounts, and consider using a hardware wallet to store your funds offline.

The Future of Crypto Lending

As the world of cryptocurrency continues to grow and evolve, I believe that we will see even more innovation in the realm of crypto lending. Already, we are seeing new platforms and services being introduced that aim to make lending even more accessible and lucrative for users.

Decentralized Lending Platforms

One of the most exciting developments in recent years has been the introduction of decentralized lending platforms like Fintoch, which allow users to lend and borrow cryptocurrency without the need for a centralized intermediary.

These platforms, which operate on the Ethereum blockchain, offer a more secure and transparent way to engage in lending and borrowing activities.

Additionally, we are seeing new lending platforms that are tailored to specific niches within the cryptocurrency industry.

For example, some platforms focus specifically on lending to traders who need funds to make margin trades, while others specialize in lending to holders of stablecoins like USDT.

Conclusion

Overall, I believe that crypto lending has a bright future ahead of it. By offering users the ability to earn passive income on their cryptocurrency holdings, these platforms are helping to democratize finance and make investing more accessible to people around the world.

If you’re interested in exploring this exciting new world of finance, I encourage you to do your research, start small, and always stay up-to-date with the latest developments in the industry.

Discover more from Digital Wealth Guru

Subscribe to get the latest posts sent to your email.

[…] investors to profit from their holdings, in fact; Crypto Lending is Highly Profitable. To engage in crypto lending, you must first deposit your assets into a lending […]