Fresh Start: Learn how to rehabilitate defaulted student loans through the limited-time program, remove the default from your credit history, and regain financial aid eligibility. Get out of default and rebuild your future.

Falling behind on student loan payments is stressful, but defaulting can feel downright devastating. If your federal student loan is in default, you’re probably dealing with collection calls, damaged credit, and even wage garnishment. However, you shouldn’t give up. There’s a lifeline called student loan rehabilitation that can help you turn things around.

In this comprehensive guide, we’ll break down everything you need to know about default student loan rehabilitation: how it works, its benefits, eligibility requirements, and the steps you need to take. We’ll also answer frequently asked questions to help you make informed decisions about your financial future.

What is Default Student Loan Rehabilitation?

Default student loan rehabilitation isn’t just a program; it’s a structured pathway designed to help you overcome the consequences of default and regain control of your financial well-being. Here’s a closer look:

A Second Chance: When a federal student loan defaults, it triggers a cascade of negative consequences—collection efforts, damaged credit, and loss of eligibility for federal student aid benefits. Rehabilitation serves as a means to erase your default status and begin anew.

Default student loan rehabilitation is a federal program designed to help borrowers with federal student loans that have fallen into default.

What is default, exactly?

When you don’t make payments on your federal student loan for a certain period (typically 270 days), your loan is considered in default. This triggers a series of negative consequences:

- Damaged Credit: Your credit score will take a significant hit.

- Collection Activities: You may face collection calls, wage garnishment, or tax refund offsets.

- Loss of Benefits: You lose eligibility for benefits like deferment, forbearance, and income-driven repayment plans.

How It Differs from Other Options:

- Loan Consolidation: While consolidation can also get you out of default, rehabilitation is often preferred as it removes the default status from your credit report, potentially leading to a better credit score.

- Repayment in Full: Paying off your defaulted loan in full is the most direct approach, but for many, it’s not financially feasible. Rehabilitation provides a more manageable solution.

The Mechanics of Rehabilitation:

- Affordable Payments: Unlike trying to catch up on missed payments all at once, rehabilitation focuses on creating a payment plan tailored to your current income and expenses.

- Measurable Success: The nine-month timeline with clear milestones (consecutive, on-time payments) makes rehabilitation a tangible and achievable goal.

- More Than Just Payments: Rehabilitation isn’t solely about catching up financially. It’s about demonstrating a commitment to responsible borrowing and repayment, which is key to rebuilding your financial reputation.

How does rehabilitation help?

Rehabilitation is like a lifeline for borrowers stuck in this situation. It’s a structured process where you agree to make a series of affordable monthly payments to your loan holder (the company servicing your loan). These payments are usually a percentage of your income, making them manageable for most borrowers.

Once you complete the rehabilitation process (usually by making nine consecutive on-time payments), your loan is considered rehabilitated. This means:

- No More Default Status: Your loan is no longer in default, and this negative mark is removed from your credit report.

- Collection Activities Stop: Wage garnishment, tax offset, and other collection actions cease.

- Eligibility for Benefits Returns: You regain access to deferment, forbearance, income-driven repayment plans, and potentially even loan forgiveness programs.

Who Benefits Most:

- Borrowers with Limited Income: The income-based payment structure of rehabilitation makes it accessible to those who might struggle with standard repayment plans.

- Borrowers Seeking Loan Forgiveness: Rehabilitation can restore your eligibility for income-driven repayment plans and Public Service Loan Forgiveness (PSLF), which could lead to eventual loan forgiveness.

- Borrowers Wanting to Improve Credit: Removing the default status from your credit report is a significant step towards improving your credit score and creating opportunities for future financial opportunities.

Beyond the Financial: Defaulting on student loans can take a toll on your mental and emotional well-being. Rehabilitation offers not only financial relief but also the chance to alleviate stress and anxiety associated with the default.

Important Note: Rehabilitation is a one-time opportunity for each defaulted federal student loan. If you default again after completing rehabilitation, you won’t be eligible to use this option again.

Student Loan Rehabilitation Program

The Student Loan Rehabilitation program is a lifeline offered by the U.S. Department of Education for borrowers who have defaulted on their federal student loans. It’s a structured process designed to help individuals regain control of their finances, repair their credit, and re-enter the world of responsible loan repayment.

Key Features of the Program:

- Affordable Payments: The program aims to establish reasonable and affordable monthly payment amounts based on the borrower’s income and expenses. This ensures that the payments are manageable and sustainable for the borrower’s financial situation.

- Consecutive Payments: To complete the program, borrowers are required to make nine consecutive on-time payments within 20 days of the due date. This demonstrates a commitment to fulfilling their financial obligations.

- Removal of Default Status: Upon successful completion of the program, the loan is no longer considered in default. This is a significant benefit, as it helps borrowers repair their credit and regain eligibility for various loan benefits and opportunities.

- Cessation of Collection Activities: One of the most immediate reliefs of the program is the stopping of collection activities. This means an end to wage garnishment, tax refund offset, and other collection actions that were in place due to the default.

- Restoration of Benefits: Successful rehabilitation restores a borrower’s eligibility for a range of benefits. These include deferment, forbearance, income-driven repayment plans, and access to future federal student aid.

- Path to Loan Forgiveness: Completing the rehabilitation program may provide access to loan forgiveness programs in certain situations. This can be a significant incentive for borrowers who work in public service or meet specific criteria.

The Fresh Start Initiative

The Department of Education’s Fresh Start initiative further enhances the Student Loan Rehabilitation program. It provides additional benefits to borrowers who rehabilitate their loans during a specific period. These benefits include:

- Removal of Default from Credit History: While rehabilitation typically removes the default status, Fresh Start goes a step further by removing the entire default history from the borrower’s credit report. This can have a substantial positive impact on their credit score.

- Waived Collection Fees: Fresh Start waives certain collection fees that are usually associated with defaulted loans. This can make the rehabilitation process more financially manageable for borrowers.

Navigating the Rehabilitation Process

To participate in the Student Loan Rehabilitation program, borrowers must actively engage with their loan holders. This involves communicating their intent to rehabilitate, negotiating a rehabilitation agreement, and consistently making on-time payments.

Borrowers must understand the terms of the rehabilitation agreement, track their payment history, and promptly address any issues that arise. Successful completion of the program opens a path toward a more secure financial future.

Benefits of Student Loan Rehabilitation

- Removal of Default Status and Credit Repair:

- The most immediate and significant benefit is the removal of the “default” status from your credit report. This can have a positive impact on your credit score, making it easier to qualify for loans, credit cards, and housing in the future.

- While rehabilitation won’t erase the negative payment history leading up to the default, it’s a crucial step toward rebuilding your creditworthiness.

- End of Collection Activities:

- Default often triggers aggressive collection efforts like wage garnishment (where a portion of your paycheck is withheld), tax refund offset (where your tax refund is seized), and other actions. Rehabilitation stops these collection activities, providing much-needed financial relief.

- Eligibility for Federal Student Aid Restored:

- Rehabilitation provides access to federal financial aid for further education. You can apply for student loans, grants, and work-study programs to help fund your studies.

- Access to Income-Driven Repayment (IDR) Plans:

- Once your loan is rehabilitated, you can enroll in an IDR plan. These plans cap your monthly payments based on your income and family size, making them more manageable. Some IDR plans even offer loan forgiveness after 20-25 years of payments.

- Deferment and Forbearance Options:

- These options allow you to temporarily pause or reduce your payments in times of financial hardship, such as unemployment or medical issues.

- Potential for Loan Forgiveness:

- Rehabilitation makes you eligible for certain federal student loan forgiveness programs. Public Service Loan Forgiveness (PSLF) is a notable example, where the remaining balance is forgiven after 120 qualifying payments while working full-time for a qualifying public service employer.

- Reduced Collection Costs:

- When a loan is in default, collection costs can be added to your balance, increasing the overall amount you owe. Rehabilitation can help minimize these additional costs.

- Peace of Mind:

- Knowing that your loan is no longer in default and that you’re taking proactive steps to manage your debt can significantly reduce stress and anxiety.

Student loan rehabilitation isn’t just about fixing a default; it’s about unlocking a range of benefits that can improve your financial well-being and create opportunities for a brighter future. If you’re struggling with defaulted student loans, rehabilitation could be the lifeline you need

Eligibility Requirements for Default Student Loan Rehabilitation

To be eligible for the student loan rehabilitation program, you must meet several specific criteria. Understanding these requirements will help you determine whether rehabilitation is a viable option for your situation.

1. Federal Student Loan:

The loan in question must be a federal student loan, such as a Direct Loan, FFEL Loan, or Perkins Loan. Rehabilitation is not available for private student loans. It’s essential to verify with your loan servicer to confirm whether your loan type qualifies for this program.

2. Defaulted Status:

Your federal student loan must be in default. This typically happens when you haven’t made payments for 270 days (approximately nine months). If your loan isn’t in default, you won’t be eligible for rehabilitation. Instead, you might explore other options like deferment, forbearance, or income-driven repayment plans.

3. One-Time Opportunity:

Rehabilitation is designed as a one-time solution for each defaulted loan. If you successfully rehabilitate a loan and default again, you won’t be eligible for rehabilitation for that specific loan again. You would need to explore alternative options like consolidation to address the subsequent default.

4. Agreement and Payment:

You must be willing to enter into a rehabilitation agreement with your loan holder and commit to making a series of reasonable and affordable monthly payments. These payments are typically based on your income and expenses, ensuring they are manageable for your financial situation. The agreement will outline the payment amount and schedule.

5. No Prior Rehabilitation:

If you have previously rehabilitated the same loan, you won’t be eligible for a second rehabilitation. This program is designed to provide a fresh start for borrowers who are experiencing default for the first time with a particular loan.

6. Not in Bankruptcy:

Generally, if your defaulted loan is currently included in a bankruptcy proceeding, you aren’t eligible for rehabilitation. However, there are exceptions if the bankruptcy court has discharged your other debts while excluding your student loans.

Additional Considerations:

- Fresh Start Initiative: The U.S. Department of Education’s temporary Fresh Start initiative may affect your eligibility for rehabilitation. This program offers unique benefits for borrowers with defaulted federal student loans and could be a viable alternative to rehabilitation. Be sure to research the Fresh Start initiative and consult with your loan holder to understand how it applies to your situation.

- Loan Holder’s Policies: While the general eligibility criteria mentioned above apply, it’s important to note that loan holders might have additional specific requirements or procedures for the rehabilitation process. Always check with your loan holder for detailed information and guidance tailored to your circumstances.

By carefully reviewing these eligibility requirements and any additional information from your loan holder, you can make an informed decision about whether default student loan rehabilitation is the right path for you.

How To Rehabilitate a Defaulted Student Loan

Here is a step-by-step guide to rehabilitating your defaulted Student Loan:

- Contact Your Loan Holder:

- Find out who your loan holder is by logging into the Federal Student Aid website (studentaid.gov) or calling the Default Resolution Group at 1-800-621-3115.

- Reach out to your loan holder and inform them you want to rehabilitate your defaulted loan. They will explain the process, answer your questions, and provide you with a rehabilitation agreement.

- Review and Agree to the Rehabilitation Agreement:

- The rehabilitation agreement will include:

- The amount of your monthly payment: This will typically be 15% of your discretionary income, but you can request a lower amount based on financial hardship.

- The number of payments required (usually nine).

- The due dates for your payments.

- Carefully review the agreement and ask your loan holder any questions you have. Once you understand and agree to the terms, sign and return the agreement.

- The rehabilitation agreement will include:

- Make On-Time Payments:

- Set up a payment schedule and make sure your payments are made on time, every month.

- Important Note: Make sure you make your payments directly to your loan holder and not to any third-party debt collectors.

- Track Your Progress:

- Keep track of your payments and make sure they are being credited to your loan.

- If you have any issues, contact your loan holder immediately.

- Complete the Rehabilitation Process:

- After you have made nine successful, on-time payments, your loan will be considered rehabilitated.

- Your loan holder will notify the credit bureaus to remove the default status from your credit report.

- You will also be able to choose a new repayment plan for your loan.

Tips for Success:

- Don’t Delay: The sooner you start the rehabilitation process, the sooner you can get your loan out of default and start rebuilding your credit.

- Budget Wisely: Review your income and expenses to ensure you can afford the monthly payments outlined in your rehabilitation agreement.

- Communicate: Stay in touch with your loan holder throughout the process and ask for help if you have any questions or concerns.

- Consider Income-Driven Repayment (IDR): After rehabilitation, you may be eligible for IDR plans, which can make your monthly payments more affordable based on your income and family size.

- Avoid Default Again: Once your loan is rehabilitated, make sure you make all future payments on time to avoid defaulting again.

Important Considerations:

- Fresh Start Initiative: If your loan was defaulted before the pandemic, you may be eligible for the Fresh Start initiative. This program automatically enrolls eligible defaulted borrowers in an IDR plan and removes the default from their credit reports.

- Loan Consolidation: If you have multiple federal loans, you may want to consider consolidating them into a Direct Consolidation Loan. This can simplify your payments and make it easier to manage your debt.

Rehabilitating your defaulted student loan takes time and commitment, but it is a worthwhile investment in your financial future. By following these steps, you can regain control of your loans, improve your credit, and move forward with your financial goals.

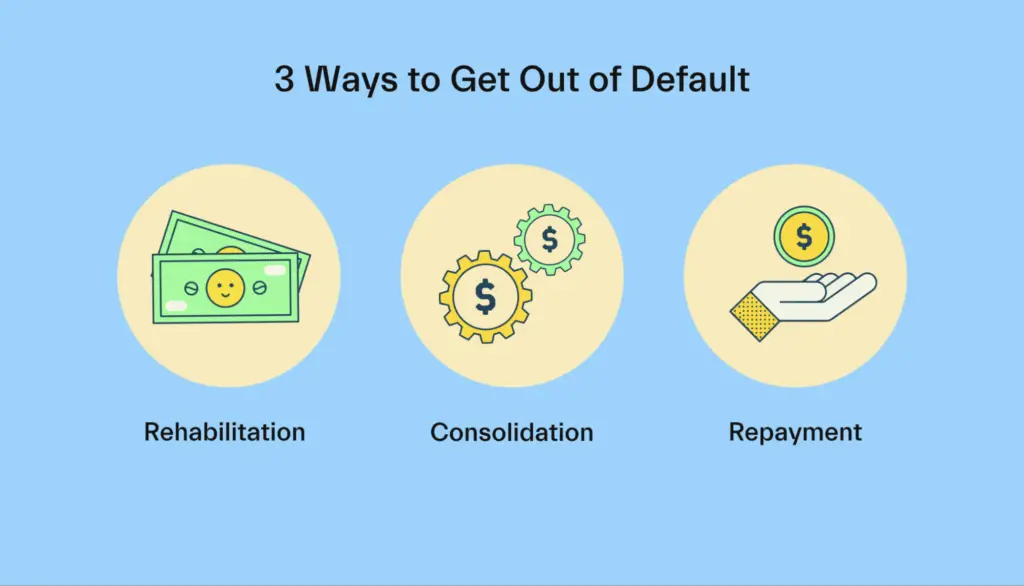

Rehabilitate a Defaulted Student Loan Alternatives

While student loan rehabilitation is a valuable option for many borrowers, it’s not the only path to resolving a defaulted student loan. Here are a few alternatives to consider:

- Student Loan Consolidation: This involves combining multiple federal student loans into a single new loan with a potentially lower monthly payment. While consolidation won’t remove the default status immediately, it can pave the way for getting out of default and accessing other repayment options.

- Student Loan Settlement: In some cases, you might be able to negotiate a settlement with your loan holder for less than the full amount owed. However, settlements often have negative impacts on your credit and may involve a lump sum payment.

- Loan Discharge or Forgiveness: Certain circumstances may qualify you for loan discharge or forgiveness, such as total and permanent disability, school closure, or specific public service employment.

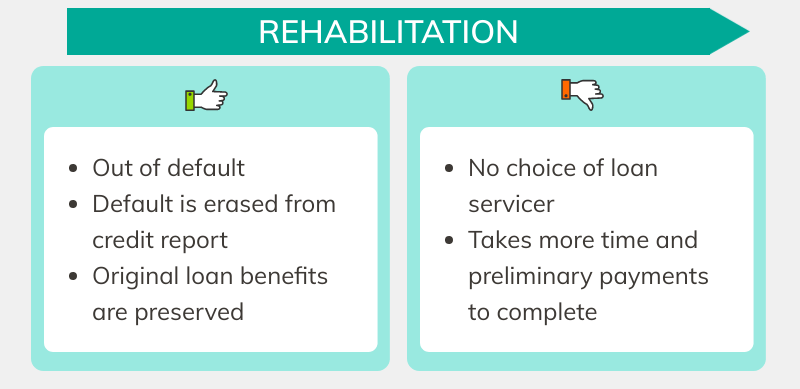

Comparing Rehabilitation to Other Options

| Option | Pros | Cons |

|---|---|---|

| Rehabilitation | Removes default status, stops collections, restores eligibility for benefits, potentially improves credit | Requires nine consecutive payments, doesn’t remove negative payment history |

| Consolidation | Simplifies repayment potentially lowers monthly payments, and opens door to get out of default | Won’t immediately remove default status; may extend repayment term |

| Settlement | Could resolve debt for less than full amount | Negatively impacts credit, may require lump sum payment, not always guaranteed |

| Discharge/Forgiveness | Eliminates debt entirely | Strict eligibility requirements, may require extensive documentation |

Which Option is Right for You?

The best option for you will depend on your circumstances, financial situation, and long-term goals. Consider factors like:

- Your financial hardship: If you’re struggling to make any payments, discharge or forgiveness might be the most viable option.

- Your credit goals: If improving your credit is a priority, rehabilitation or consolidation might be better choices.

- Your long-term repayment plans: Consider whether you want to explore income-driven repayment plans or loan forgiveness programs.

Important Note: Always consult with your loan holder or a financial advisor before making any decisions about your defaulted student loans. They can provide personalized guidance and help you choose the path that best suits your needs.

Conclusion: Student Loan Rehabilitation program

While defaulting on your student loans is a significant issue, there is still hope for recovery. Student loan rehabilitation offers a valuable opportunity to overcome default, rebuild your financial health, and work towards a brighter future.

If you’re struggling with defaulted student loans, don’t hesitate to contact your loan holder and explore this option.

Discover more from Digital Wealth Guru

Subscribe to get the latest posts sent to your email.

Comments