On to the latest trend that’s sweeping the Internet called NFT now selling for a huge $69 million bucks. So, what’s behind this latest craze? That is the question to ask.

Okay, so there’s some super strange stuff happening online right now, and I need to tell you about it. First look at this tweet:

The first tweet ever tweeted in the history of Twitter. The tweet was by Jack Dorsey. “I’m one of the co-founders of Twitter” This tweet was somehow just purchased for $2,915,835.47.

Just last month, a single JPEG was sold for $69 million. The NBA sold little moments of basketball games for hundreds of dollars. There are all sorts of digital things that people are purchasing a version of for an unimaginable amount of money.

There are basically three (3) simple letters that will help us understand what’s going on in the crypto space; those letters are N F T.

- What is the latest trend sweeping the Internet off-balance?

- what exactly is this thing called NFT?

- Not Safe For Work?

- What does NFT stand for?

- What does NFT mean to human existence?

- Why would you pay for an NFT when you can look at it for free?

- Is this a gigantic bubble just waiting to burst?

These are some of the questions that this article will address. I strongly believe in this crypto space with my whole heart and I’m just fascinated by every happening, especially as it keeps creating new ways of making money online.

This story is much bigger than a $600,000 cat GIF for a $3 million tweak. It’s a story about human psychology and the way we value things to keep. shifting because of technological development and advancement.

The same technology that some people think may revolutionize our society while at the same time accelerating the climate disaster. It’s really nuts.

What Is NFT?

NFT stands for non-fungible token. Okay, is that it? Yes of course; that’s the full meaning. To fully understand what NFT is all about and how to make money online with it; we need to break down every part of it and define it separately before looking at it as a whole.

Does the line Non-fungible token make sense to you?, for me, it didn’t when I first came across it until I started researching the topic “What is NFT?“.

One of my issues with this topic is that people throw around things like blockchain, crypto, art, and Ledger NFT and they just expect us to understand what they are talking about, and I didn’t at first. Do you?

What Is Fungible?

Let’s talk about the word “Fungible” – it’s this very specific word that economists have been using, and it has a very precise definition. In order to make this easier and understandable to everyone, I want to use a different word but with the same meaning for fungible for a second – let’s interchange it with the word “replaceable”. I believe you understand it now.

What is Non-Fungible?

Non-fungible means non-replaceable – you can’t replace it. There’s only one of them. It’s unique non-fungible. Let me give you an example of something I feel very strongly about. Let’s say you want to buy an orange jacket. This is really absurd. I’ve actually never counted these before…..

You want to buy an orange jacket from Amazon. You go on the Internet, and a jacket costs $39. If you purchase one of these jackets for $39, you don’t care what specific jacket they send to you. They’re going to make 1000s of jackets in your size, send them to stores, send them to people, and they will send one to you. You don’t care which one it is.

The jacket is fungible; it’s replaceable as long as you get one that’s identical to the rest. It’s worth the same to you. They’re interchangeable.

However, let’s talk about one unique orange jacket that has been with me for a very long time now. This is the original, and for those of you who don’t know, I sort of have a strange attachment to this jacket. I just love it.

I love the colour and feel like an identity with this thing, and it’s sort of starting to disintegrate, but I love it, and I kind of fell in love with it.

This jacket is not replaceable – Non-fungible. If I went onto the website and paid $39 for a unique Amazon orange jacket that is this exact same model. It would not be this jacket. This jacket is non-fungible, it is the only one on the planet that exists.

It has emotional value. It has significance; it is a very valuable thing because it is scarce. There’s only one of them. It’s valuable to me, at least, and I kind of fell in love.

Everything in our economy is one or the other, fungible or non-fungible. A bag of rice is fungible. You just want to buy you don’t care which one it is. The Mona Lisa is non-fungible; there’s only one. Unsurprisingly, non-fungible things are way more valuable than fungible things.

So that’s the NF in NFT, non-fungible. Now let’s talk about the T, which is a Token; this is a very internetting word, and to explain this, I have to explain something I have avoided explaining for a very long time; “The blockchain”.

The Blockchain

Luckily, there’s a way to understand this, and I’m going to make it as painless as possible.

Let’s say I want to buy three slices of pizza from my friend Anna; she charges me $6 For these three slices, I don’t use cash anymore. So I pull up my debit card and my bank card, and I swipe on her little terminal. As soon as I swipe this card, a message is sent to my bank.

The message says; Hey, Johnny, who has an account at your bank, wants to spend $6 on pizza, and that money needs to go to Anna’s bank.

This is like the bread and butter of what a bank does all day, they document every transaction that comes in from all their customers, and they send out money to the other banks. At the end of the day, they have a tally of all the money that went out of your account and into your account.

They can give you a number; they can say, based on all of these transactions, you have $50 in your bank account.

So when that request comes in, as I swipe my card, my bank is like, okay, so based on all of your transactions, you have $50 in your account; I can send $6 to Anna’s bank approved, and they approve the transaction.

Once that money comes into Anna’s bank, his bank does the same thing. They’re like, oh, cool, she had $80. And now she has 86 and they add it to her record.

Your money is just a number on a screen. It’s the result of a bunch of transactions. You don’t barter with physical things, and you don’t use cash as much.

So the bank, keeping meticulous records of every transaction, becomes really important. We trust the bank to do this correctly. So thank you Bank and other middlemen who have been keeping stuff like this running smoothly for centuries.

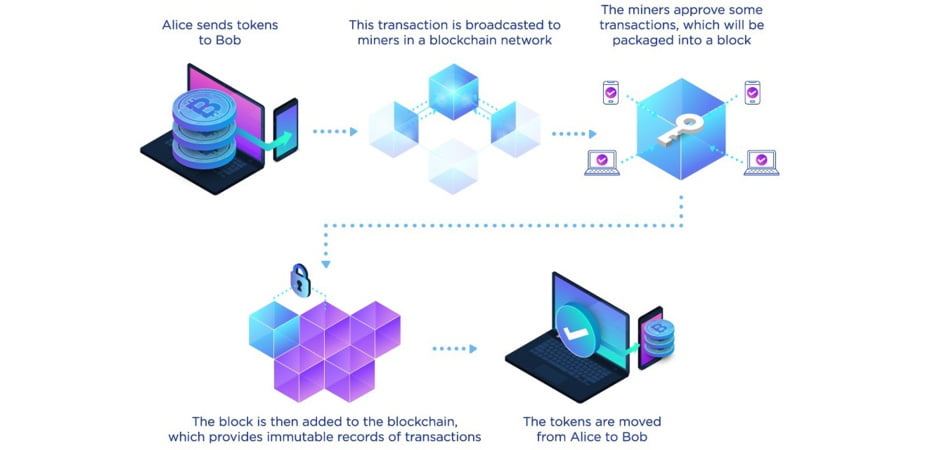

With the rise of the Internet, people started to wonder, is there a way that we could do the same thing to coordinate this transaction of transfer of money between two people without the bank? the result is a very clever concept called the blockchain.

The Usefulness of Blockchain

The blockchain fulfils the same thing the bank was doing, but instead of doing this privately on my bank account and talking to Anna’s bank, all of the transactions are actually recorded publicly on the internet.

So let’s redo this example in a crypto world; they charged me 6 crypto coins for my 3 slices of pizza. I got to swipe my bank card to say YES to the purchase of 6 crypto coins, instead of the bank seeing that request for a transaction and trying to validate it; It goes on to this public record where a bunch of people’s computers all around the world are keeping track of every single transaction of everyone always.

If I don’t indeed have the 6 crypto coins in my account to pay Ana, all of the people’s computers who are keeping track of every single transaction will notice that there’s a discrepancy. They’ll be like; you don’t have 6 coins. We’re looking at every transaction ever, and you don’t have 6 coins, so your transaction is rejected.

If I do have six coins, all of the computers looking at the public record will see that request for a transaction, and they’ll be like, yep, approved, you have six coins. Now Anna has six coins, and they’ll write that transaction into the public record.

Anna, having those six extra coins is now the business of everybody. Everybody now knows that. The point here is that the group verifies the legitimacy of every transaction but keeps an eye on every transaction to make sure that it adds up.

How Does Blockchain Relate With NFT

You might be wondering, what do the blockchain and this public record have to do with the cat GIF that was sold for $600,000? Well, I’m about to tell you.

So, in my pizza example, we talked about blockchain as a way to verify currency transactions: I pay you this much, you pay me this much, and everybody knows how much everybody has because it’s all public. This is where it starts to bend my mind a little bit.

What if we apply this to something that isn’t money or currency?

Let’s say one day, you’re just looking at the ledger and the ledger is like Johnny wants to give Anna six coins. Okay, he’s got six coins approved, and then a transaction comes up.

That’s like, a Malaysian businessman wants to give $3 million worth of coins to Jack Dorsey in exchange for a little token or digital certificate that says that the tweet is now somehow owned by the Malaysian businessman.

What differentiates Blockchain from the Bank?

The only thing that the blockchain cares about is the Malaysian businessman has $3 million worth of coins. A bunch of computers all around the world look at the entire list of transactions and say like, Yeah, this guy has more than $3 million worth of coins – approved, they approve the transaction.

Now it is written in an unalterable public record that says this Malaysian businessman owns this treat, and the token has been transferred to somebody’s new non-fungible token, otherwise known as NFT.

How Is NFT Different from Cryptocurrency?

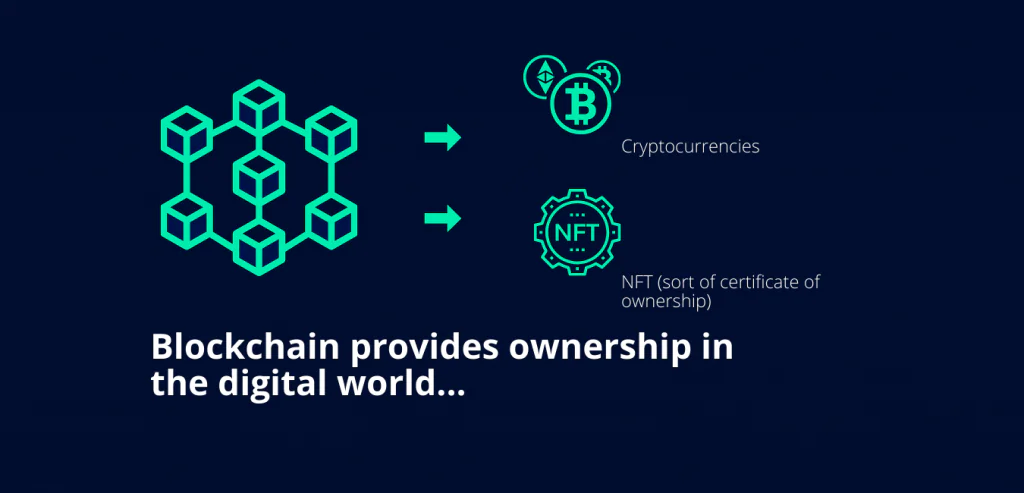

NFT is generally designed using specific software and hosting on blockchain as cryptocurrencies like Bitcoin or Ethereum, but that’s where the similarity stops.

Paper money and cryptocurrencies are “fungible” as we have discussed earlier, meaning they can be exchanged for one another. Cryptocurrencies are also equal in value – say 1 Bitcoin is always worth is equal to or worth the same amount as 1000 Ethereum.

Cryptocurrency’s fungibility nature makes it a trusted means of carrying out business transactions on the blockchain.

NFTs are different. Each NFT has a digital signature that makes it impossible for NFTs to be exchanged for or equal to one another (hence, non-fungible). One NBA Top Shot clip, for example, is not equal to every day simply because they’re both NFTs. (One NBA Top Shot clip isn’t even necessarily equal to another NBA Top Shot clip, for that matter).

The fact that both as built and hosted on the blockchain does not make them the same – cryptocurrency is fungible, and NFT is non-fungible.

How NFT Work?

NFTs exist on the blockchain, which is a distributed public ledger that records transactions that happen globally.

Specifically, most NFTs are hosted on the Ethereum blockchain, although other blockchains like Polygon now support NFTs as well.

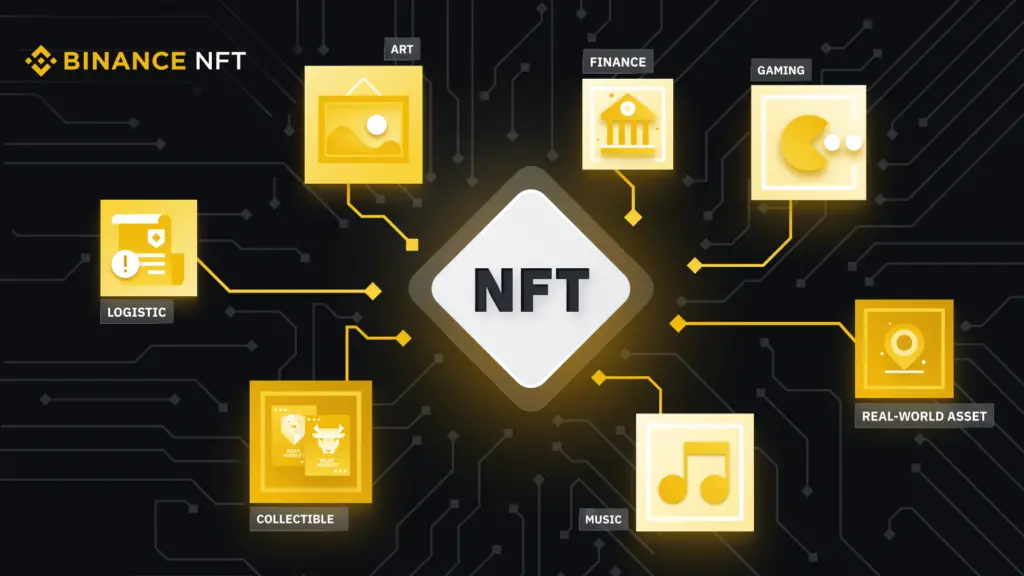

An NFT is created or “minted” in a digital format to represent both tangible and intangible items, events, and special moments:

- Art

- GIFs

- Videos and sports highlights

- Collectables

- Virtual avatars and video game skins

- Designer sneakers

- Music

They are traded in a special environment like “Opensea” with specific encrypted market conditions that guide the smooth transaction between the buyer and the seller.

How Do People Make Money From NFT?

Blockchain technology and NFTs afford artists and content creators a unique opportunity to monetize their art. For example, artists no longer have to rely on galleries or auction houses to sell their artwork.

Instead, the artist can auction it directly to the consumer as an NFT on the NFT Marketplace, which also lets them keep more of the profits.

In addition, artists can program in royalties so they’ll receive a percentage of sales whenever their art is sold to a new owner. This is an attractive feature as artists generally do not receive future proceeds after their art is first sold to the initial buyer.

Artwork isn’t the only way to make money with NFTs. Brands like Charmin and Taco Bell have auctioned off themed NFT art to raise funds for charity. Charmin dubbed its offering “NFTP” (non-fungible toilet paper), and Taco Bell’s NFT art sold out in minutes, with the highest bids coming in at 1.5 wrapped ether (WETH)—equal to $3,723.83 at the time of writing this article.

Nyan Cat, a 2011-era GIF of a cat with a pop-tart body, sold for nearly $600,000 in February. And NBA Top Shot generated more than $500 million in sales as of late March. A single LeBron James highlight NFT fetched more than $200,000.

Even celebrities like Snoop Dogg, Lindsay Lohan, Amitabh Bachchan, and Salman Khan are jumping on the NFT bandwagon, releasing unique memories, artwork, and moments as securitized NFTs. Even the Multi-level marketing industries are now rewarding their top sellers with Royalty NFTs.

How Humans Place Value on Non-fungible Things

If there’s anything that gets human psychology to value something, it’s if an entire group validates that it’s real and that there’s only one of them. There are 10s of 1000s of NFTs of all kinds.

Some music is being given tokens. Lots of art is being minted as tokens and being bought and sold, and then, of course, there’s NBA Top Shot, who’s taking advantage of these highlight moments; these Top Shot moments from your favourite NBA players have been turned into non-fungible tokens.

Jesse made headlines the other day when he paid $208,000 For LeBron James’s Top Shot, that’s the weirdest thing.

As soon as humans have enough abundance and have their basic needs met food, shelter, warmth, etc. The next frontier is to create value in things that have no inherent value. The value turns into psychological hype and excitement around a certain thing.

We’ve been doing that forever. I mean, the whole art industry is based on the idea of a bunch of people deciding that this painting, this little bit of Canvas, and wood and paint is valuable, and thus it is valuable.

The only difference about now is we now have the technology to do this in a non-physical way, using this very sophisticated internet technology that is maturing very quickly.

Okay, so this is a lot of hype, and I know you’re probably thinking, cool, there’s a bunch of rich people online buying and trading digital art, and there are millions of dollars worth of cards. I thought you said that this was going to have the potential to change the world.

Oh yes! Relax – I’m getting there. But first, I need to talk about the crazy flip side of the NFT fad.

The Crazy Flip Side To The NFT Boom

The reality is that the technology that is the backbone for all of this blockchain stuff that we’ve been talking about relies on the public ledger thing that I talked about like that is the sort of heart and soul conceptually, but mechanically, like physically what it relies on is computers doing a bunch of little calculations all day and night forever.

These computers are real computers, and they don’t have any memory or screens or anything big. All they do is just make little micro calculations all day and all night.

Most NFTs are stored on a blockchain called cerium. For now, the Ethereum blockchain is using 33 terawatt hours of electricity, and you’re like, what’s? – a terawatt hour of electricity? That’s the same amount of power as the country Serbia.

This a reminder that generating electricity usually comes from power plants that are burning fossil fuels that are putting carbon into the atmosphere, which is a big freakin problem, a manmade disaster on a global scale.

The power consumption of the Ethereum blockchain is exploding; it just quadrupled in like eight months, and it is showing no signs of slowing down. It is a lot of energy, and to think that much energy is not being used to, like, move people around or produce things.

It’s used to crunch numbers in a weird computer warehouse somewhere so that somebody can buy a fake token of a thing that we only – Oh man, I just can’t imagine. It’s just mind-blowing. It’s such an ironic moment where it’s like – this is all digital. It’s all fake. It’s not real, but it’s having deeply real-world effects.

What NFT Means To Our World

I just want to finish this article now, talking about what this might mean for our world going forward. This is definitely hype, and that’s the whole point. I mean, these speculation markets are all about hype.

We see this all the time, with new technologies and new things that people get excited about. And they swarm it with their investments, and the price goes up and then something happens.

In the ’90s, the Internet was taking off, and people were just realizing that you could make money on the Internet, you could make big businesses on the Internet. The stock market was surging 400% in five years, mainly fueled by so much hype and excitement around these new internet corrects.

The record has it as America’s longest boom, the new economy.

This rise peaked in March of 2000, and then the bubble burst; a lot of these companies either went under or completely lost all of this exciting valuation that they had good news down.

- Did that mean that the internet went away?

- Did that mean that the Internet businesses didn’t come back?

No companies have gone on to reshape our world right now.

How to Buy NFTs

If you’re keen to start your own NFT collection, you’ll need to acquire some key items:

First, you’ll need to get a digital wallet that allows you to store NFTs and cryptocurrencies.

You’ll likely need to purchase some cryptocurrency, like Ether, depending on what currencies your NFT provider accepts. You can buy crypto using a credit card on platforms like Coinbase, Kraken, eToro, and even PayPal and Robinhood now.

You’ll then be able to move it from the exchange to your wallet of choice.

You’ll want to keep fees in mind as you research options. Most exchanges charge at least a percentage of your transaction when you buy crypto.

Popular NFT Marketplaces

Once you’ve got your wallet set up and funded, there’s no shortage of NFT sites to shop. Currently, the largest NFT marketplaces are:

- OpenSea.io: This peer-to-peer platform bills itself as a purveyor of “rare digital items and collectibles.” To get started, all you need to do is create an account to browse NFT collections. You can also sort pieces by sales volume to discover new artists.

- Rarible: Similar to OpenSea, Rarible is a democratic, open marketplace that allows artists and creators to issue and sell NFTs. RARI tokens issued on the platform enable holders to weigh in on features like fees and community rules.

- Foundation: Here, artists must receive “upvotes” or an invitation from fellow creators to post their art. The community’s exclusivity and cost of entry—artists must also purchase “gas” to mint NFTs—means it may boast higher-calibre artwork. For instance, Nyan Cat creator Chris Torres sold the NFT on the Foundation platform. It may also mean higher prices — not necessarily a bad thing for artists and collectors seeking to capitalize, assuming the demand for NFTs remains at current levels or even increases over time.

Although these platforms and others are hosts to thousands of NFT creators and collectors, be sure you do your research carefully before buying. Some artists have fallen victim to impersonators who have listed and sold their work without their permission.

In addition, the verification processes for creators and NFT listings aren’t consistent across platforms — some are more stringent than others.

OpenSea and Rarible, for example, do not require owner verification for NFT listings. Buyer protections appear to be sparse at best, so when shopping for NFTs, it may be best to keep the old adage “caveat emptor” (let the buyer beware) in mind.

Conclusion

I think we are probably in that stage of NFTs. It’s hype. It’s a novel. It’s exciting – but what it’s doing right now is that; it’s pushing our minds to think differently about how we validate, value, and verify things.

If I buy a house, there is a whole thick stack of paperwork and a bunch of middlemen to make sure that it is very clear who owns the home and how that money gets transferred from one person to another. It is like a nightmare of an experience.

If technology suddenly existed that took away the centralized middleman and made transactions between people able to be authenticated, verifiable, much smoother, and faster, that could change our world. I’m not here to say if the bubble is gonna burst or whether NFT is real or Not.

I just know that this is a crazy moment where we’re getting our heads around new technology and what it means; as usual, we will adjust and adapt eventually. This won’t be crazy, and this won’t be novel anymore after some time. NFT Prices will go DOWN and UP again. The technology that allowed it all to happen will probably stick around.

Discover more from Digital Wealth Guru

Subscribe to get the latest posts sent to your email.

[…] know you have heard about the word NFT somewhere, but you still don’t understand what it is all about, and why a company like Meta […]

[…] What is meta Force NFT? […]

[…] know you have heard about the word NFT somewhere, but you still don’t understand what it is all about, and why a company like Meta […]