Making a simple budget can initially appear daunting, but here’s the truth: You can do it. Wondering how? Just break it down into manageable steps. After all, no one tackles a mammoth task by attempting to swallow it whole.

Similarly, no one becomes a budgeting pro overnight. It’s a gradual process, one step at a time.

So, let’s dive in, step by step. Here’s a comprehensive guide on how to make a simple budget in five easy steps.

What Are The 5 Steps Of Budget Preparation?

Step 1: List Your Income

Step 2: List Your Expenses

Step 3: Subtract Expenses From Income

Step 4: Monitor Your Expenditure (All Month Long)

Step 5: Before the month begins, create a new budget.

How To Make a Simple Budget In 5 Easy Steps

Step 1: List Your Income

Before planning your expenses, you need to know how much money you have to work with. Your income encompasses your regular paychecks and any additional funds from side hustles, garage sales, freelance gigs, or other sources.

To organize this, create separate income budget lines for each paycheck you and your spouse receive and any supplementary income. Ensure you work with your net income, which you earn after taxes and deductions. For example:

- His Paycheck 1: $1,500

- Her Paycheck 1: $1,500

- His Paycheck 2: $1,500

- Her Paycheck 2: $1,500

- Side Hustle: $500

- Total Income: $6,500

If your income is irregular, base your planned payment on the lowest amount you’ve earned over the past few months. If you make more, you can adjust this figure later in the month, putting the surplus towards your financial goals or other budget categories.

Step 2: List Your Expenses

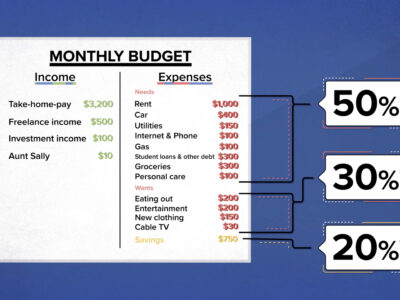

Once you’ve accounted for your income, it’s time to plan your expenses. Start with allocating money for giving (generally 10% of your income) and savings goals, such as building an emergency fund. These are essential aspects of your budget.

Next, focus on your Four Walls: food, utilities, shelter, and transportation. Create budget categories for each of these and list your specific expenses within each category. Some expenses, like rent or mortgage, will remain fixed, while others, like groceries or gasoline, may vary.

Estimating your grocery expenses can be challenging, but a reasonable estimate based on your past spending will suffice. You’ll refine this figure as you gain more experience.

Include all other monthly expenses, starting with essentials like insurance, debt payments, childcare, etc. Add a miscellaneous category for other necessary costs and non-essentials like personal spending, entertainment, and fun money. Estimate the amounts for each expense category using your online bank account or bank statements.

If you aim to save money, reduce debt, or work toward other financial goals, cutting back on non-essential spending will help you achieve them faster. If you’re uncertain about your priorities, consider following the 7 Baby Steps plan, which breaks down essential financial goals into manageable steps.

Create new budget categories for any additional expenses you identify. For instance, if you frequently dine out, add a “Restaurants” line under the “Food” category. Remember that groceries are a necessity, but eating out extravagantly is not.

Step 3: Subtract Expenses From Income

It’s time for some math, but don’t worry; it’s manageable. Subtract all your expenses from your income, aiming for a total of zero—a zero-based budget. Leave a small buffer of about $100–$300 in your account to avoid hitting zero exactly.

A zero-based budget ensures that every dollar has a designated purpose: spending, giving, saving, or debt repayment. Your money works hard for you, and you have complete control over it.

If you have a surplus after covering all expenses, allocate that money toward your current financial goals. Conversely, if your expenses exceed your income, you must adjust by reducing expenses until your budget balances.

Start trimming discretionary spending, such as eating out and entertainment, but avoid spending more than you earn.

If the math feels overwhelming, consider using a budgeting tool like EveryDollar, which simplifies zero-based budgeting and eliminates the need for manual calculations.

Step 4: Monitor Your Expenditure (All Month Long)

One of the most critical secrets to successful budgeting is tracking your transactions meticulously. Record every expenditure, no matter how minor, throughout the month. Your budget plan is just a set of intentions without this crucial step.

Every time you spend money—filling up your gas tank, paying rent, or grabbing a coffee on your way to work—deduct the corresponding amount from the appropriate budget category.

Review your budget frequently and make any adjustments. If an expense turns out to be higher than anticipated, reallocate funds from another category to cover it. Conversely, if a cost is lower than expected, celebrate the savings by directing that money toward your financial goals or a category that exceeded its budget.

Tracking your transactions serves several vital purposes:

- It holds you accountable for your budget and financial goals.

- It prevents overspending by providing real-time visibility into remaining budget balances.

- It keeps your budget current and adaptable, allowing you to make necessary adjustments.

- It helps you identify spending habits and make corrections to stay on track with your goals.

Step 5: Before the month begins, create a new budget.

While your budget may not change drastically from month to month, creating a new budget at the start of each month is essential. This proactive approach enables you to anticipate and prepare for upcoming expenses.

To create your new budget, copy the previous month’s budget and adjust for any new or seasonal expenses. Examples include birthdays, holidays, seasonal purchases, semiannual expenses, and annual obligations like eye exams or pet vaccinations.

Create a budget category, such as “Month-Specific Stuff” or “Alternating Expenses,” and add the budget lines for the upcoming month. Reallocate funds from other categories or explore opportunities to increase your monthly income.

Remember that budgeting can initially feel complicated or cumbersome, but it typically takes about three months to become comfortable with it. Be patient with yourself, and keep refining your budget as you go. The benefits of budgeting far outweigh the initial effort.

Why Make a Budget?

Budgeting isn’t just about restricting spending; it’s a strategy for giving your money purpose and taking control of your financial future. It alleviates money-related anxiety and helps you set and achieve financial goals.

Making a budget is a fundamental financial practice with numerous benefits. Here are some compelling reasons why creating and sticking to a budget is essential:

- Financial Control: A budget gives you control over your money. It enables you to keep track of your income and expenses, assisting you in understanding where your money is going and empowering you to make deliberate financial decisions.

- Financial Goals: Budgeting is the foundation for achieving your financial goals. Whether you want to save for a vacation, buy a home, pay off debt, or retire comfortably, a budget helps you allocate funds toward these objectives.

- Debt Management: A budget helps you manage and reduce debt effectively. By setting aside a set amount each month for debt repayment, you can pay off your obligations more quickly and avoid paying interest.

- Emergency Preparedness: Building an emergency fund through budgeting gives you a safety net in case of unforeseen costs like medical bills, auto repairs, or job loss. This reduces the need to rely on credit or go into debt during emergencies.

- Reduced Financial Stress: Knowing where your money is going and having a plan reduces financial stress and anxiety. You’ll have a clear picture of your financial situation and confidence to handle your responsibilities.

- Improved Saving Habits: Budgeting encourages regular saving. By setting aside money for savings goals, you’ll develop a habit of saving and gradually build wealth over time.

- Identification of Wasteful Spending: Tracking expenses through a budget helps you identify unnecessary or wasteful spending habits. This awareness allows you to reduce non-essential costs and allocate those funds toward more meaningful goals.

- Better Decision-Making: With a budget, you can make informed financial decisions. You’ll have the information to prioritize spending, make wise investments, and avoid impulsive purchases.

- Financial Freedom: A well-managed budget can lead to financial freedom. As you pay off debt, build savings, and invest wisely, you gain more control over your financial future and can enjoy a higher quality of life.

- Peace of Mind: Perhaps one of the most significant benefits of budgeting is the peace of mind it brings. You’ll know you’re on track with your financial goals, which can reduce stress and improve your overall well-being.

- Improved Relationships: For couples, budgeting can improve communication about money matters and reduce financial conflicts. It ensures that both partners are on the same page regarding financial goals and spending priorities.

- Financial Awareness: Budgeting encourages you to become more aware of your financial habits and patterns. This awareness can positively change how you manage money and make financial decisions.

- Asset Protection: By budgeting and saving, you protect your assets and financial future. You’re less vulnerable to financial setbacks and better equipped to weather economic downturns.

Making a budget is a proactive step toward financial stability and success. It empowers you to take charge of your finances, achieve your goals, and enjoy greater peace of mind.

Whether you aim to eliminate debt, save for the future, or better understand your financial situation, a budget is an essential tool to help you get there.

By crafting and sticking to a budget, you tell your money where to go, eliminating the mystery of where it disappeared. Budgeting empowers you, putting you in charge of your financial destiny. It permits you to spend your money in ways that align with your priorities.

In essence, making a budget is one of the most crucial decisions for your financial well-being. It’s a tool that enables you to gain confidence in managing your money effectively.

So, it’s time to take the plunge and start your budgeting journey. You can work towards your long-term financial objectives and achieve economic stability with commitment and perseverance.

Tips On How to Budget With Confidence

Monthly budget planning sheet with pen and US dollars

Now that you understand the steps to create a budget and the importance of budgeting, it’s time to dive in with confidence.

Here are some additional tips to help you make the most of your budgeting experience:

- Set Clear Financial Goals: Identify your financial objectives, whether building an emergency fund, paying off debt, saving for a vacation, or investing for retirement. Having clear goals will motivate you to stick to your budget.

- Regularly Review Your Budget: Don’t just create and forget about a budget. Review your budget regularly, ideally at least once a week, to ensure you’re on track and progressing toward your goals. Adjustments may be necessary as life circumstances change.

- Involve Your Spouse or Partner: If you share finances with a spouse or partner, involve them in budgeting. Collaborative budgeting fosters open communication about money matters and ensures you’re aligned with your financial goals.

- Use Budgeting Tools: Take advantage of budgeting apps and software, like EveryDollar, to streamline the budgeting process. These tools can automate calculations, track transactions, and provide valuable insights into your spending habits.

- Emergency Fund: Prioritize building an emergency fund to cover unexpected expenses. A financial safety net can prevent you from derailing your budget when unexpected bills arise.

- Avoid Impulse Purchases: Stick to your budget by avoiding impulse purchases. If something isn’t in your budget, consider it carefully before spending money on it. Delaying non-essential purchases can help you make more informed decisions.

- Track and Celebrate Progress: Celebrate your achievements as you work toward your financial goals. Whether paying off a credit card or reaching a savings milestone, acknowledging your progress can boost your motivation to continue budgeting effectively.

- Seek Professional Advice: Consult a financial advisor when facing complex financial situations. They can provide personalized guidance and help you make informed investment decisions, retirement planning, and more.

- Stay Persistent: Budgeting can be challenging, and setbacks may occur. Don’t be discouraged by occasional overspending or unexpected expenses. Stay persistent and continue refining your budgeting skills.

- Educate Yourself: Take time to educate yourself about personal finance. The more you understand money management, investing, and financial planning, the better you’ll be able to make wise financial decisions.

Additional Tips On How to Budget With Confidence

11. Embrace Frugality: One of the fundamental principles of budgeting is frugality. This doesn’t mean you must live a life of extreme thriftiness, but adopting frugal habits can help you make the most of your budget. Look for ways to save money, such as purchasing generic products, preparing meals at home rather than eating out, or locating free or inexpensive entertainment choices.

12. Automate Savings and Bill Payments: Set up automatic transfers to your savings account and automated bill payments whenever possible. This minimizes the possibility of late penalties or missing payments by ensuring you constantly save money and pay your key bills on time.

13. Create a Debt Repayment Plan: If you have debts, prioritize paying them off. Create a debt repayment plan outlining how much you’ll allocate to monthly debt payments. As you pay off debts, redirect those funds toward savings or other financial goals.

14. Emergency Fund: We mentioned this earlier, but it’s worth reiterating. Having an emergency fund is crucial. It provides financial security and prevents unexpected expenses from derailing your budget. Aim to build an emergency fund equivalent to three to six months’ living expenses.

15. Save for the Future: Budgeting isn’t just about meeting immediate needs and securing your financial future. Allocate a portion of your budget to retirement savings or other long-term goals like buying a home or funding your children’s education.

16. Be Mindful of Lifestyle Inflation: As your income increases, avoid the temptation to increase your spending proportionally. Instead, allocate the extra income toward your financial goals. This prevents lifestyle inflation and accelerates your progress toward financial independence.

17. Review and Adjust Your Budget: Life is dynamic, and your financial circumstances can change. Review your budget frequently and make any required modifications to account for additional costs, shifting priorities, or variations in income. Flexibility is a crucial aspect of successful budgeting.

18. Financial Education: Continue to educate yourself about personal finance. Books, podcasts, online courses, and financial seminars can provide valuable insights and strategies to help you manage your money more effectively.

19. Seek Support and Accountability: Tell a family member or trusted friend about your financial objectives so they can encourage you and hold you accountable. Discussing your financial aspirations with someone you trust can help you stay motivated.

20. Practice Patience and Persistence: Budgeting is a journey, and financial goals may take time. Be kind to yourself and continue to do the same amount of work. Small, consistent steps can lead to significant financial improvements over time.

Conclusion: Creating a Budget

Making and maintaining a budget is a powerful tool that can transform your financial life. It empowers you to take control of your money, eliminate financial stress, and work toward your dreams and aspirations.

Remember that everyone’s financial status is unique, and there’s no one-size-fits-all approach to budgeting. The key is consistently following through with your goals and values and creating a budget that aligns with your goals and values.

With dedication, discipline, and a commitment to making informed financial choices, you can experience the peace of mind and economic security of effective budgeting. It’s your path to financial freedom and realizing your financial dreams.

Discover more from Digital Wealth Guru

Subscribe to get the latest posts sent to your email.

Comments