Budgeting – a term that often evokes mixed emotions. “What are some key components of successful budgeting?” – a regular question from my budgeting online class.

For some, budgeting is a beacon of financial stability and a roadmap to achieving dreams. It’s a daunting task for others, akin to navigating a blindfolded labyrinth.

Yes, I once belonged to the latter group. But through years of trial and error, I’ve come to understand the key components of successful budgeting.

In this journey towards financial freedom, I’ve discovered that it’s not just about crunching numbers; it’s a lifestyle, a mindset, and a powerful tool for shaping the life you want.

Let’s embark on this journey together as I share the crucial elements of successful budgeting, backed by my personal experiences.

Let’s face it, finances can be stressful. Between mounting bills, surprise expenses, and long-term goals, it’s easy to feel overwhelmed. But fear not, fellow adventurer on the path to financial freedom! Budgeting is your secret weapon.

What is Budgeting?

Imagine a roadmap for your money. Budgeting is the process of creating a plan for your income and expenses over a specific period. In essence, you tell your money where to go, instead of wondering where it went.

Why Budget?

The benefits of budgeting are vast, but here are a few key reasons to embrace it:

- Financial Peace of Mind: Knowing exactly where your money goes reduces anxiety and empowers you to make informed financial decisions.

- Debt Control: Budgeting helps you stay on top of debt payments and develop a strategy to become debt-free.

- Goal Achievement: Large purchases like a car or a dream vacation become attainable when you consistently save towards them.

- Building an Emergency Fund: Life throws curveballs. A well-funded emergency fund helps you weather unexpected financial storms.

- Improved Spending Habits: Tracking expenses creates awareness and allows you to identify areas where you can cut back.

Budgeting Myths Debunked!

Here’s the truth about some common budgeting myths:

- Myth #1: Budgeting is Restrictive: Budgeting empowers you, not restricts you. It gives you control over your money.

- Myth #2: Budgeting is Too Complicated: There are simple and user-friendly methods for everyone.

- Myth #3: Budgeting Takes Too Much Time: Investing a little time upfront saves you money and stress in the long run.

- Myth #4: Budgeting Won’t Work for Me: Budgeting is for everyone, regardless of income or financial situation.

20 Key Components Of Successful Budgeting

1. Set Clear Financial Goals

My journey into budgeting started with setting clear financial goals. A budget is like a ship without a rudder that aimlessly cruises around without a destination.

Think about what you want to achieve financially. It could be anything from paying off debt to buying a home or saving for an exotic vacation. Be specific, be ambitious, and most importantly, be realistic.

My experience: Years ago, I was buried under a mountain of student loan debt. I set a clear goal to become debt-free within five years. This goal became the North Star of my budgeting journey. Every financial decision I made was geared towards that objective, and I tracked my progress religiously.

2. Track Your Income and Expenses

Budgeting begins with understanding your financial inflows and outflows. Track every source of income and categorize every expense, no matter how small it may seem. This will give you a clear picture of your financial landscape.

My experience: I started using budgeting apps to track my income and expenses. It was an eye-opening experience. I became aware that I was blowing a sizable chunk of my salary on impulsive purchases. Seeing those numbers on the screen motivated me to make changes.

3. Create a Realistic Budget

Now that you clearly understand your finances, it’s time to create a budget. Be realistic when allocating funds to different categories. Don’t set overly restrictive limits that you can’t stick to, but don’t underestimate your expenses.

My experience: In my initial attempts, I made the mistake of setting extremely tight budgets for non-essential categories like dining out and entertainment. This led to frustration and eventually breaking the budget. Over time, I learned to strike a balance by allowing myself some flexibility while ensuring I saved consistently.

4. Prioritize Savings and Emergency Fund

One of the fundamental components of a successful budget is prioritizing savings. Make saving a non-negotiable part of your budget. Whether for retirement, a rainy day, or a specific goal, allocate a portion of your income to monthly savings. Create an emergency fund as well to pay for unforeseen costs.

My experience: Building an emergency fund was a game-changer for me. It provided a safety net that prevented me from falling into debt when life threw unexpected curveballs, like car repairs or medical bills.

5. Monitor and Adjust Regularly

Budgeting is not a one-and-done task. It requires constant monitoring and adjustment. Regularly review your budget to ensure you’re on track with your goals. If a particular category consistently exceeds its limit, consider adjusting it or finding ways to reduce expenses.

My experience: Life is dynamic, and so are your financial circumstances. My income increased over the years, allowing me to allocate more funds to savings and investments. However, it also meant adjusting my budget to accommodate a higher cost of living.

6. Eliminate Debt Strategically

Your path to financial freedom may be obstructed significantly by debt. Give priority to paying off high-interest obligations, such as credit card bills as soon as possible. Consider strategies like debt snowball or debt avalanche to tackle multiple debts systematically.

My experience: I used the debt snowball method to repay my student loans. Starting with the smallest balance, I made extra payments while maintaining minimum payments on other debts.

As each loan was paid off, I snowballed the freed-up funds into the next one. It was a gratifying process that eventually led to debt freedom.

7. Embrace Frugality and Smart Spending

Successful budgeting often involves adopting a frugal mindset. Pay attention to your spending patterns and seek out ways to save money without compromising your quality of life. Seek discounts, buy in bulk, and consider DIY alternatives for certain expenses.

My experience: I was amazed at how much I could save by making small changes in my spending habits. I started cooking at home more often, canceled unused subscriptions, and shopped strategically during sales. These seemingly minor adjustments had a significant impact on my budget.

8. Plan for the Future – Investments and Retirement

Budgeting isn’t just about managing day-to-day expenses; it’s also about securing your financial future. Allocate funds for investments and retirement savings. Take advantage of employer-sponsored retirement plans and explore other investment opportunities to grow wealth.

My experience: I redirected those funds toward investments as my debt diminished. I started with a 401(k) through my employer and later ventured into individual stocks and index funds. Watching my assets grow over time was incredibly motivating.

9. Seek Professional Guidance

If you’re overwhelmed or dealing with complex financial situations, don’t hesitate to seek professional advice. Financial advisors can provide tailored strategies to optimize your budget and investments.

My experience: When I reached a point where I wanted to diversify my investments beyond basic stocks and bonds, I consulted a financial advisor. Their expertise helped me make informed decisions about more advanced investment options.

10. Stay Committed and Patient

Budgeting is a long-term commitment. It requires patience and discipline. There will be challenges and setbacks, but staying committed to your financial goals will ultimately lead to success.

My experience: I faced setbacks, like unexpected medical bills and car repairs, which temporarily derailed my budget. However, I reminded myself of my long-term goals and adjusted my budget accordingly. Over time, these setbacks became mere blips on my financial journey.

11. Emphasize Financial Education

Ongoing financial education is a vital yet frequently disregarded component of effective budgeting. The more you understand personal finance, investment options, and money management, the better you’ll be able to make informed decisions.

My experience: I realized the importance of financial literacy during my budgeting journey. I started reading books, attending seminars, and following financial blogs. This knowledge empowered me to make smarter financial choices and avoid common pitfalls.

12. Automate Your Savings and Payments

Automate your savings and bill payments to make budgeting easier and more consistent. Set up automated deposits to your investment and savings accounts on each payday. This ensures that you prioritize your financial goals without the temptation to spend those funds elsewhere.

My experience: Automating my savings made a world of difference. I never had to worry about forgetting to save or pay bills on time. It also helped me stick to my budget by removing the temptation to spend money allocated for savings.

13. Celebrate Milestones

Budgeting can sometimes feel like a never-ending journey. Celebrate progress along the road to keep yourself inspired. Acknowledge your progress, whether paying off a credit card, reaching a specific savings goal, or achieving a significant investment milestone.

My experience: Celebrating milestones boosted my motivation and reinforced my sense of accomplishment. It made budgeting feel less like a chore and more rewarding.

14. Teach Budgeting to Others

Sharing your budgeting knowledge with friends or family can be a rewarding experience. You can help others improve their financial lives, and teaching budgeting concepts can also solidify your understanding.

My experience: I started offering budgeting advice to friends struggling financially. Teaching them forced me to clarify my budgeting principles and learn from their unique challenges.

15. Adapt to Life Changes

Your financial condition could vary over time because life is erratic. Be ready to modify your spending plan in response to significant life changes, such as marriage, parenthood, changes in your work, or unanticipated windfalls.

My experience: When I married, my budget had to accommodate a second income and joint financial goals. Similarly, I had to revise my budget for childcare expenses when I became a parent. Flexibility is key to maintaining a successful budget.

16. Practice Mindful Spending

Budgeting is not just about restricting spending; it’s also about spending mindfully. Consider the value and long-term impact of your purchases. Prioritize spending on experiences and items that align with your values and goals.

My experience: Mindful spending helped me distinguish between needs and wants. I started making conscious choices about where I allocated my money, which reduced impulsive purchases and increased satisfaction with my spending decisions.

17. Maintain an Emergency Fund

I mentioned the importance of an emergency fund earlier, but it bears repeating. Having an emergency fund gives you financial security, reduces stress, and keeps unanticipated expenses from deviating from your budget.

My experience: There were instances where my emergency fund saved me from financial turmoil, like when my car needed major repairs or when I faced unexpected medical bills. It reinforced the importance of having a financial cushion.

18. Review and Adjust Your Goals

As you achieve your financial goals, setting new ones is essential. Review your budget periodically and adjust your goals to reflect changing priorities, aspirations, and circumstances.

My experience: Achieving my initial goal of becoming debt-free was a monumental milestone. But I didn’t stop there. I set new goals, such as saving for a down payment on a home and increasing my retirement contributions.

19. Stay Accountable

Accountability is a powerful motivator in budgeting. Discuss your financial objectives with a family member or close friend who you can rely on to keep you motivated and on track.

My experience: Having an accountability partner made me more accountable to my budget. Having someone to discuss financial decisions with and share progress updates was reassuring.

20. Practice Self-Compassion

Finally, remember that budgeting is a journey, and perfection is not the goal. Be kind to yourself during setbacks or when you deviate from your budget. Learn from mistakes and use them as opportunities for growth.

Tips For Successful Budgeting

Here are some additional tips for successful budgeting:

- Pay yourself first. When you get paid, set aside a certain amount of money for savings before you pay any bills or other expenses. This will help you save money without even thinking about it.

- Automate your finances. Pay your invoices on time and set up a standing instruction to regularly move money from your bank account to your savings account. By doing this, you’ll be able to stay on budget and avoid late penalties.

- Eliminate unnecessary expenses. Take a close look at your budget and identify any unnecessary expenses. You may be surprised at how much money you can save by cutting out small expenses, such as daily coffee shop runs or unused subscriptions.

- Make a budget buddy. Find a friend or family member who is also interested in budgeting. You can support each other and stay motivated.

Budgeting can be challenging at first, but it is a valuable skill to help you reach your financial goals. You can create a simple budget that suits your needs and aids you in reaching your financial goals by using the advice in this article.

Crafting Your Budget: Step-by-Step

Ready to take charge? Let’s break down the budgeting process into manageable steps:

Step 1: Gather Your Financial Arsenal

- Income: Collect pay stubs, bank statements, and anything that shows your income for a month.

- Expenses: Gather bills, receipts, and bank statements to track where your money goes. Consider using a spending tracker app for a month to get a clear picture.

Step 2: Categorize Your Expenses

Divide your expenses into categories like rent/mortgage, groceries, utilities, transportation, entertainment, debt payments, etc.

Step 3: Choose Your Budgeting Method

There are several budgeting methods, each with its own strengths. Here are a few popular choices:

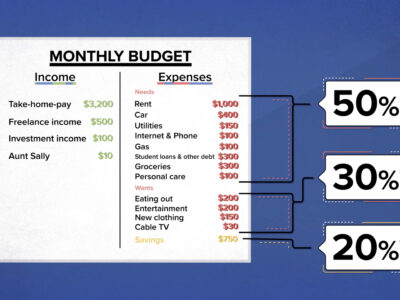

- 50/30/20 Rule: This simple method allocates 50% of your income to needs (housing, food), 30% to wants (entertainment), and 20% to savings and debt repayment.

- Zero-Based Budgeting: Every dollar of your income is assigned a job (spending or saving) before the month begins.

Step 4: Track Your Progress

There are many budgeting apps and spreadsheets available to help you track your income and expenses. Choose a method that works for you, be it pen and paper, a spreadsheet, or an app.

Step 5: Review and Adapt

Your budget is a living document, not set in stone. Review your spending regularly and adjust categories as needed. Don’t be discouraged if you have setbacks; identify the reason and recommit to your goals.

Best Budgeting App

Your unique demands and tastes will determine which app is the best for managing your finances. However, some of the most popular and well-regarded budgeting apps include:

- Mint: Automatic cost monitoring, budgeting, and financial planning tools are just a few features of Mint’s free budgeting program. Also, Mint offers information about your spending patterns and assists you in finding opportunities to cut costs.

- YNAB: You Need a Budget (YNAB) is a paid budgeting app using zero-based budgeting. YNAB helps you to assign every dollar of your income to a specific expense, such as rent, food, or savings. This method can help you ensure that you are not overspending and are progressing towards your financial goals.

- EveryDollar: EveryDollar is another zero-based budgeting app that is similar to YNAB. EveryDollar is also a paid app, but it is less expensive than YNAB.

- PocketGuard: With the aid of the budgeting application PocketGuard, you can keep tabs on your expenditures and spot opportunities to cut costs. PocketGuard also provides recommendations for how to save money on your bills and other expenses.

- Goodbudget: A budgeting program called Goodbudget employs the envelope method. The envelope budgeting method involves assigning each expense to a specific envelope. You then spend from the envelope for that expense until the money runs out. This method can help you to stay on track with your budget and avoid overspending.

When choosing a budgeting app, it is important to consider the following factors:

- Features: What features are important to you? Do you want an app that automatically tracks your spending? Do you want an app that helps you to create a budget? Do you want an app that provides insights into your spending habits?

- Price: Budgeting apps can range in price from free to paid. Consider your budget when choosing a budgeting app.

- Ease of use: How easy is the app to use? Do you find the interface to be user-friendly?

- Customer support: Does the app offer good customer support?

I recommend you try a few budgeting apps to see which works best for you. Most budgeting apps offer a free trial period to test them out before you commit to a paid subscription.

My Experience

The Early Days: Budgeting Blunders

In my early twenties, budgeting was a mythical creature whispered about by responsible adults. My income went on rent, groceries, and…well, everything else. I’d constantly overspend, leaving me scrambling before payday arrived like a phantom. I dabbled in a few budgeting methods – the 50/30/20 rule initially, then a trendy budgeting app – but enthusiasm fizzled faster than a damp firework.

Why I Failed:

Looking back, here’s what torpedoed my budgeting attempts:

- Unrealistic Expectations: I naively thought budgeting was a magic bullet, solving my financial woes overnight. It takes time, dedication, and the occasional tweak to become second nature.

- Lack of Tracking: Expense tracking? More like expense ignoring. Out of sight, out of mind, right? This made it impossible to identify sneaky spending gremlins draining my accounts.

- No Defined Goals: I wandered aimlessly without a financial compass. Saving for the sake of saving felt like filling a bottomless pit. Budgeting without a target is a recipe for discouragement.

The Turning Point:

The defining moment arrived when a travel itch morphed into a full-blown desire for a European adventure. However, my spending habits resembled a leaky sieve. My dream vacation was rapidly transforming into a distant mirage.

Embracing Budgeting:

So, I revisited budgeting, this time with a laser focus on my travel dream. Here’s what transformed my budgeting game:

- Zero-Based Budgeting: I switched to zero-based budgeting, where every dollar gets assigned a purpose. Knowing every cent had a job made me a more mindful spender.

- Expense Tracking: I committed to meticulous expense tracking for a month. It was an eye-opening experience! Categorizing every penny revealed just how much I was hemorrhaging on unnecessary things (hello, daily lattes!).

- Goal Visualization: I created a vision board plastered with captivating pictures of European adventures. Seeing it daily fueled my motivation and kept me laser-focused on my financial target.

The Results:

This time, budgeting is stuck. I identified areas to cut back (goodbye, impulse lattes!) ruthlessly, started saving aggressively, and even unearthed ways to boost my income through a freelance side hustle. Within a year, I’d stockpiled enough cash to embark on my dream European adventure!

Budgeting Beyond the Goal:

Budgeting blossomed into more than just a tool to fund my travels. It empowered me to:

- Pay Off Debt: I tackled lingering student loans with renewed vigor. Every dollar saved was a brick laid on the path to financial freedom.

- Build an Emergency Fund: Having a safety net for unexpected car troubles or medical bills brings immense peace of mind.

- Invest for the Future: I kickstarted my retirement savings journey, taking control of my long-term financial well-being.

Budgeting Takeaways:

My budgeting odyssey instilled valuable lessons:

- Budgeting is a Tool: It’s not a punishment or a restrictive cage; it’s a powerful tool to unlock your financial dreams.

- Find Your Method: Experiment with different budgeting approaches until you discover one that clicks. There’s no one-size-fits-all solution.

- Goals are Key: Set clear and achievable financial goals to stay motivated. Seeing the progress you make fuels your budgeting fire.

- Be Flexible: Budgeting is a lifelong adventure, not a rigid rulebook. Adapt it as your life changes and financial goals evolve.

Your Budgeting Success Story:

Now I want to hear from you! Share your budgeting experiences (victories or woes) in the comments below. Let’s cultivate a supportive community where we can all learn and grow financially together. Remember, conquering your finances and achieving your dreams is absolutely within reach!

Conclusion: Key Components Of Successful Budgeting

Successful budgeting is a dynamic and transformative process beyond spreadsheets and calculations. It’s a journey of self-discovery, discipline, and empowerment.

Through personal experiences and continuous learning, I’ve come to appreciate the multifaceted nature of budgeting. It’s not just about managing money; it’s about shaping your desired life.

As you embark on your budgeting journey, embrace these components and remember that financial freedom is achievable with dedication, adaptability, and a clear vision for your financial future.

Budgeting FAQs: Your Burning Questions Answered

Budgeting can feel daunting, but fret no more! This section tackles frequently asked questions to empower you on your financial journey.

Q: How much should I save?

There’s no magic number, but a good starting point is 10-20% of your income. However, it depends on your goals. Saving for retirement? Aim for 15% or more. Saving for a house? You might need to sock away a higher percentage.

Q: What are some common budgeting mistakes?

- Unrealistic expectations: Don’t expect instant results. Budgeting is a marathon, not a sprint.

- Not tracking expenses: You can’t manage what you don’t measure! Tracking helps identify spending leaks.

- Ignoring goals: Without a target, budgeting feels pointless. Set clear financial goals to stay motivated.

- Being inflexible: Life throws curveballs. Adapt your budget as needed.

Q: How can I stick to my budget?

- Automate your finances: Set up automatic transfers to savings and bill payments to avoid missed payments and late fees.

- Review regularly: Schedule budget check-ins to assess progress and make adjustments.

- Embrace technology: Budgeting apps can simplify tracking and categorizing expenses.

- Reward yourself: Celebrate milestones! Reaching a saving goal? Treat yourself to something small to stay motivated.

Q: What if I mess up?

We all do! Don’t beat yourself up. Just get back on track with your next paycheck. Remember, consistency is key.

Q: Is there a difference between budgeting and frugality?

Budgeting is about planning your spending, while frugality is about being mindful and avoiding waste. They can work hand-in-hand. However, budgeting allows you to splurge occasionally without guilt, while extreme frugality might restrict you from enjoying life’s little pleasures.

Q: What if I have irregular income?

Budgeting with fluctuating income requires extra planning. Here are some tips:

- Track income and expenses for a few months: This establishes an average income baseline.

- Use the “envelope system” with cash: Allocate cash to different spending categories to manage your money more effectively.

- Build a buffer: Focus on building an emergency fund to cover periods of lower income.

Q: How can I involve my family in budgeting?

- Have a family budget meeting: Discuss financial goals and involve everyone in the decision-making process.

- Assign age-appropriate tasks: Older children can help track expenses, while younger ones can learn the value of saving.

- Make it fun: Use budgeting apps or games to make budgeting an engaging family activity.

Remember, successful budgeting is a journey, not a destination. It takes time, effort, and continuous learning. But with the right approach and mindset, you can unlock financial freedom and achieve your financial goals!pen_sparktunesharemore_vert

Discover more from Digital Wealth Guru

Subscribe to get the latest posts sent to your email.

Comments