What is your Paycheck Routine like? – It’s easy to spend without realizing how quickly it adds up. A daily $5 coffee, $15 lunch, $4 transport, $2 treat, and $1.40 on subscriptions might seem harmless, but over a year, that’s around $10,000 gone! This lack of awareness often results from not having a structured paycheck routine.

Managing your money with intention can transform your financial situation, as it did for me, helping me become the first millionaire in my family. In this blog post, I’ll share a detailed plan you can implement every time you get paid to save money, build wealth, and work toward your financial independence.

Step 1: Separate Your Wants and Needs

Understanding the Basics

The foundation of any sound financial plan is distinguishing between “wants” and “needs.” While this concept seems straightforward, it requires honest self-reflection. Our consumer-driven society often blurs the lines, making luxuries seem essential.

Practical Exercise

- List Your Expenses: Use a pen and paper or a digital spreadsheet to create two columns for “Wants” and “Needs.”

- Analyze Your Spending: Look at six months of bank statements and categorize each recurring expense. This exercise will highlight areas where your money is going and help you identify unnecessary spending.

- Calculate Your Financial Baseline: Sum up your “Needs” column to determine your baseline monthly expenses. Ideally, this should be under 50% of your income. However, aiming for 25% gives you more flexibility and room for savings and investments.

Adjusting Your Lifestyle

Reducing your financial baseline might involve lifestyle changes. For instance:

- Housing: Consider relocating to a more affordable area or downsizing your home.

- Transport: Evaluate the necessity and cost of your vehicle. Public transport or a less expensive car might be viable options.

- Utilities and Services: Consider reducing bills, such as using energy-efficient appliances or renegotiating service contracts.

Increasing Your Income

If cutting costs isn’t enough, consider ways to increase your income. This could involve seeking a promotion, switching to a higher-paying job, or starting a side hustle. The key is to balance income growth with controlled spending to maximize savings.

Step 2: Save 20% in a High-Interest Savings Account

Building an Emergency Fund

An emergency fund is crucial for financial security, providing a safety net during unexpected events such as medical emergencies, job loss, or significant repairs. Aim to save 20% of your monthly income into a high-interest savings account separate from your main account to avoid the temptation to spend it.

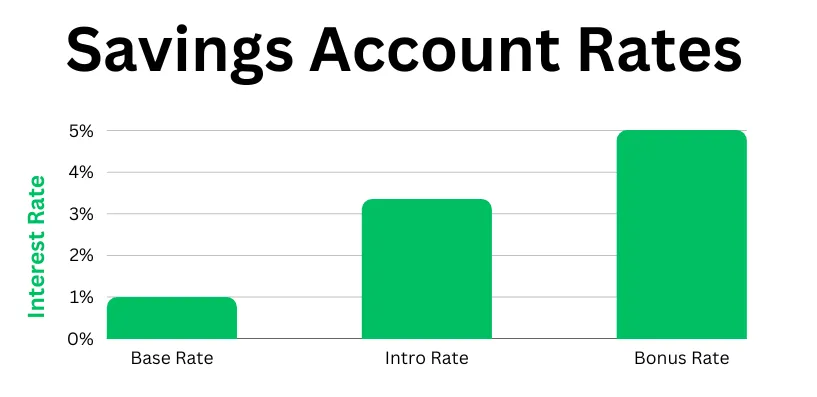

Choosing the Right Account

- Interest Rates: Look for accounts with the highest available interest rates. Even in low-interest environments, maximizing what you can earn on your savings is important.

- Accessibility: Ensure that the account allows easy access to funds in an emergency without significant penalties.

Target Savings Amount

Your emergency fund should cover three to six months of your baseline expenses. This buffer can help you navigate financial shocks without incurring debt.

Step 3: Pay Off High-Interest Debt

Why Focus on High-Interest Debt?

High-interest debt, such as credit card balances or payday loans, can significantly hinder your financial progress. The interest rates on these debts often far exceed what you could earn through investments, making debt repayment a priority.

Debt Repayment Strategies

- Avalanche Method: Prioritize paying off debts with the highest interest rates first. This method saves the most money in interest payments over time.

- Snowball Method: Focus on paying off the smallest debts first. This method can be psychologically motivating, as paying off debts faster can create a sense of accomplishment.

Implementing a Repayment Plan

Create a budget that allocates 30% of your paycheck towards debt repayment. This approach will reduce your debt faster, improve your credit score, and free up more money for savings and investments in the future.

Step 4: Invest in a Tax-Advantaged Account

Why Invest?

Investing is crucial for long-term wealth building. While saving is essential for short-term goals and emergencies, investing allows money to grow over time, outpacing inflation and increasing wealth.

Tax-Advantaged Accounts

- Stocks and Shares ISA (UK): Allows tax-free growth on your investments.

- Roth IRA (US): Offers tax-free withdrawals in retirement, provided certain conditions are met.

Investment Strategy

Allocate 35-40% of your excess income to these accounts, focusing on low-cost index funds like the S&P 500. Index funds are diversified, reducing risk while providing solid returns over the long term. Even small, consistent contributions can grow significantly over time due to compound interest.

Automation and Consistency

Automate your investments to ensure consistency and reduce the temptation to spend. Set up automatic transfers to your investment accounts and let compound interest work in your favour.

Step 5: Explore High-Risk, High-Reward Investments

Balancing Risk and Reward

While the previous steps focus on building a stable financial foundation, high-risk, high-reward investments can accelerate wealth accumulation. However, these investments should only be made with money you can afford to lose.

Options to Consider

- Start a Side Hustle: Use 5-10% of your paycheck to fund a side business. A small initial investment can often yield substantial returns if managed wisely.

- Cryptocurrency Investments: Cryptocurrencies like Bitcoin and Ethereum can be volatile but offer the potential for significant returns. Limit your exposure to 5% of your investment portfolio to manage risk.

Diversification and Risk Management

Diversify your high-risk investments to spread risk. Always do thorough research before investing in new ventures, and consider consulting with a financial advisor if needed.

The Magic of Compound Interest

As you implement these strategies, it’s crucial to understand the role of compounding in wealth accumulation. Compounding is the process where your earnings generate even more earnings over time. It’s often described as the “eighth wonder of the world” because of its exponential impact on investment growth.

How It Works:

When you invest, you earn returns on both your initial and accumulated returns over time. This creates a snowball effect, where the growth of your investments accelerates as your balance increases.

Example:

Suppose you invest $250 monthly into a tax-advantaged account with an average annual return of 8%. In 45 years, your investments could grow to approximately $1.3 million, thanks to the power of compounding. This illustrates the importance of starting early and being consistent with your investments.

The Importance of Patience and Consistency

Investing is a long-term game. Market fluctuations are normal, and staying focused on your long-term goals is essential rather than being swayed by short-term market volatility. Here are some tips to keep in mind:

- Stay Invested: Time in the market is more critical than timing the market. Consistently investing, regardless of market conditions, allows you to benefit from market upswings and reduces the impact of downturns.

- Diversify Your Portfolio: Spreading your investments across different asset classes reduces risk. This means you won’t be overly exposed to the poor performance of a single asset.

- Reinvest Dividends: If you’re investing in stocks or funds that pay dividends, reinvest these dividends to take full advantage of compounding.

Conclusion: The Best Paycheck Routine

Implementing a paycheck routine is a transformative step toward financial independence. By separating your wants and needs, saving, paying off debt, investing, and exploring high-risk opportunities, you can systematically build wealth and secure your financial future. Remember, the key is consistency and discipline.

Adjust these steps to fit your circumstances and continue educating yourself about personal finance. The journey to financial freedom is a marathon, not a sprint, but with a solid plan, you can achieve your goals.

Discover more from Digital Wealth Guru

Subscribe to get the latest posts sent to your email.

Comments