Becoming a millionaire is a dream for many, but few achieve it. Why? The answer lies in a fundamental concept: the performance gap. This blog post will explore how to close that gap, using strategies that have helped me and countless others succeed financially.

If you’re serious about becoming a millionaire in 2025, this guide is for you.

Understanding the Performance Gap

Most people never become millionaires because they fail to grasp the importance of the performance gap. This gap represents where you are now and where you want to be. The road to wealth isn’t a straight line; it’s filled with ups and downs. Many people get lost along the way, their paths winding aimlessly, preventing them from reaching their financial goals.

The secret to closing the performance gap is obsession with progress, growth, and improvement. Those who succeed in becoming millionaires are the ones who continuously strive to close this gap, no matter the obstacles.

Key Takeaway: Your success is directly proportional to your commitment to bridging the performance gap. The sooner you identify this gap in your life and start working towards closing it, the faster you’ll reach your goals.

The Millionaire Mindset: Providing Perceived Value

The amount of money you make is always directly proportional to the amount of perceived value you provide. But what exactly does “perceived value” mean? It’s the value others see in what you offer, whether a product, a service, or an idea.

To become a millionaire, you need to focus on solving big problems. The bigger the problem you solve, the more value you create and the more money you’ll make. The concept is simple yet incredibly powerful.

Practical Exercise: Finding Your Value Zone

- Draw a Venn Diagram with three circles:

- What you love to do: Anything from hobbies like writing or playing sports to passions like technology or design.

- What you’re good at: Identify your strengths—are you a great communicator, a skilled designer, or a natural leader?

- What people will pay you for: Think about services or products people need and are willing to pay for.

- Identify the Intersection: Your Value Zone is the sweet spot where these three circles overlap. This is where you should focus your efforts to maximize your income and satisfaction.

Common Financial Pitfalls:

- Choosing Passion Alone: Loving what you do is important, but it can quickly become a source of stress rather than joy if it doesn’t pay the bills.

- Relying Solely on Skill: Good at something doesn’t always translate into financial success. Ensure there’s a market willing to pay for your expertise.

- Chasing Money Alone: High-paying jobs that you hate can lead to burnout. Strive for a balance that includes passion, skill, and profitability.

Selecting the Right Financial Vehicles

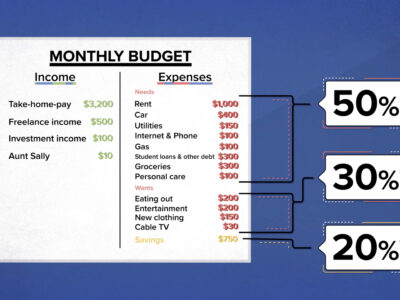

Would you rather have a million dollars in assets or earn millions annually? The answer is both, and to achieve this, you need two different financial vehicles: one for making money and one for investing it.

1. Active Income: Your income should be your main vehicle for generating wealth. This could be a service-based business, a product-based business, or a content creation business like YouTube.

- Service-Based Business: Minimal startup costs make this ideal for beginners. It’s flexible, scalable, and can be done from a laptop.

- Product-Based Business: This involves creating and selling physical or digital products. While it requires more upfront investment, it can lead to significant passive income over time.

- Content Creation: Platforms like YouTube or blogging allow you to create content that generates income through ads, sponsorships, and affiliate marketing.

2. Passive Income: Your passive income vehicle should be focused on investments that grow your wealth over time.

- Investing in Stocks: Platforms like Trading 212 make investing in a diversified portfolio easy. You can set up automatic investments and let compound interest work its magic over time.

- Real Estate: Another excellent passive income source, real estate can provide steady cash flow and appreciate over time.

- Dividend Stocks: Investing in companies that pay dividends allows you to earn regular income while holding onto your investments.

Key Tip: Don’t treat investing like a side hustle; it’s a long-term strategy for growing wealth. Be patient and let your investments compound over time.

The Myth of Multiple Income Streams

You’ve probably heard the saying, “You need seven income streams to become a millionaire.” While diversification is important, spreading yourself too thin can slow your progress. Instead, focus on one or two primary income streams until they’re fully developed and generate substantial income.

Activity: Allocating Your Resources

- Make a List: Write down everything you do in your life, personal and professional.

- Graph Your Resources: Create a graph to allocate your money, time, and energy to each activity.

- Analyze: Identify which activities are consuming the most resources without providing a significant return on investment.

You can build wealth faster and more effectively by focusing your resources on fewer high-impact activities.

Overcoming Obstacles, Not Making Excuses

Every journey to wealth is filled with obstacles, but the key is not to let them become excuses. Everyone faces challenges, whether it’s lack of education, poor financial background, or personal struggles. The difference between those who succeed and those who don’t is how they handle these challenges.

Actionable Advice:

- Reframe Your Thinking: Instead of saying, “I can’t do this,” ask yourself, “How can I overcome this obstacle?”

- List Possible Solutions: Brainstorm multiple ways to overcome each challenge you face. Some ideas will work; others won’t, but persistence is key.

The Power of Continuous Learning

One of the biggest mistakes people make is stopping their education after leaving school. Lifelong learning is crucial for closing the performance gap. The more you learn, the more you earn. Knowledge compounds just like interest; over time, it can lead to exponential growth in your personal and professional life.

Steps to Continuous Learning:

- Challenge Yourself: Take on new projects or roles that push you out of your comfort zone.

- Read Regularly: Books, articles, and online courses can provide new insights and knowledge.

- Network: Surround yourself with people who are more intelligent than you. Learn from their experiences and expertise.

Remember, if you’re not growing, you’re stagnating. Keep feeding your mind with new information to stay ahead of the curve.

Conclusion: Become a Millionaire In 2025

Success requires sacrifice. If you’re not willing to sacrifice for your dream, your dream becomes the sacrifice. Closing the performance gap is tough, but it’s the only way to achieve financial freedom and become a millionaire.

If you’re ready to take your wealth-building journey to the next level, start by identifying your value zone, selecting suitable financial vehicles, and focusing on continuous learning. The road to becoming a millionaire in 2025 is paved with hard work, dedication, and smart decisions.

Discover more from Digital Wealth Guru

Subscribe to get the latest posts sent to your email.

Comments