Unveiling the Secrets of Tax-Free Wealth Accumulation

At the heart of The Ultimate Tax-Free Wealth Blueprint lies a strategic approach to wealth creation centered on tax-deferred and tax-free retirement accounts. This strategy emphasizes maximizing the use of vehicles such as Individual Retirement Accounts (IRAs) and Roth IRAs to accumulate wealth over time without incurring immediate taxes.

The Power of Tax-Deferred and Tax-Free Accounts

IRAs and Roth IRAs offer distinct advantages, making them cornerstone tools for tax-free wealth accumulation. IRAs provide tax-deferred growth, meaning that contributions are tax-deductible, and investment earnings grow tax-deferred until withdrawals are made in retirement.

This tax deferral allows individuals to retain more investment earnings, leading to accelerated wealth accumulation.

On the other hand, Roth IRAs offer tax-free growth, meaning that contributions are made with after-tax dollars, but withdrawals in retirement are tax-free. This tax-free treatment allows individuals to enjoy the full benefits of their investment earnings without incurring additional taxes in retirement.

Tax-Deferred and Tax-Free Accounts

Tax-deferred and tax-free accounts are financial vehicles that provide individuals with specific tax advantages. These terms refer to how investment earnings and withdrawals are treated from a tax perspective. Here’s an overview of each:

- Tax-Deferred Accounts:

- Definition: In tax-deferred accounts, you delay paying taxes on the contributions and earnings until later, usually when you withdraw.

- Example: Traditional IRAs and 401(k)s are classic examples of tax-deferred accounts. Contributions to these accounts are often tax-deductible, and the investment gains within the account grow tax-deferred. When you withdraw funds during retirement, you’ll pay ordinary income taxes on contributions and accumulated earnings.

- Benefits:

- Immediate tax benefits through deductions on contributions.

- Potential for compounding growth as taxes on gains are deferred.

- Considerations:

- Withdrawals are taxed as ordinary income.

- Required Minimum Distributions (RMDs) may apply at a certain age.

- Tax-Free Accounts:

- Definition: In tax-free accounts, contributions are made with after-tax dollars, but qualified withdrawals, including earnings, are not subject to income taxes.

- Example: Roth IRAs and Roth 401(k)s are common tax-free accounts. Contributions to these accounts are not tax-deductible, but qualified withdrawals (usually made in retirement and meeting specific criteria) are entirely tax-free.

- Benefits:

- Tax-free withdrawals in retirement.

- No RMDs during the account holder’s lifetime.

- Considerations:

- No immediate tax deductions for contributions.

- Income limits may restrict contributions to Roth accounts.

Key Differences:

- Tax Timing:

- Tax-deferred accounts delay taxes until withdrawals.

- Tax-free accounts involve paying taxes on contributions but offer tax-free withdrawals.

- Withdrawal Taxation:

- Tax-deferred accounts result in taxable withdrawals (ordinary income).

- Tax-free accounts allow for tax-free withdrawals if conditions are met.

- Contributions:

- Tax-deferred accounts often allow tax-deductible contributions.

- Tax-free accounts involve contributions made with after-tax dollars.

- RMDs:

- Tax-deferred accounts like traditional IRAs have RMDs starting at a certain age.

- Tax-free accounts like Roth IRAs do not have RMDs during the account holder’s lifetime.

Choosing between tax-deferred and tax-free accounts depends on factors such as current and expected future tax brackets, investment goals, and eligibility for specific accounts based on income. It’s advisable to consult with a financial advisor to create a strategy that aligns with your unique financial situation and objectives.

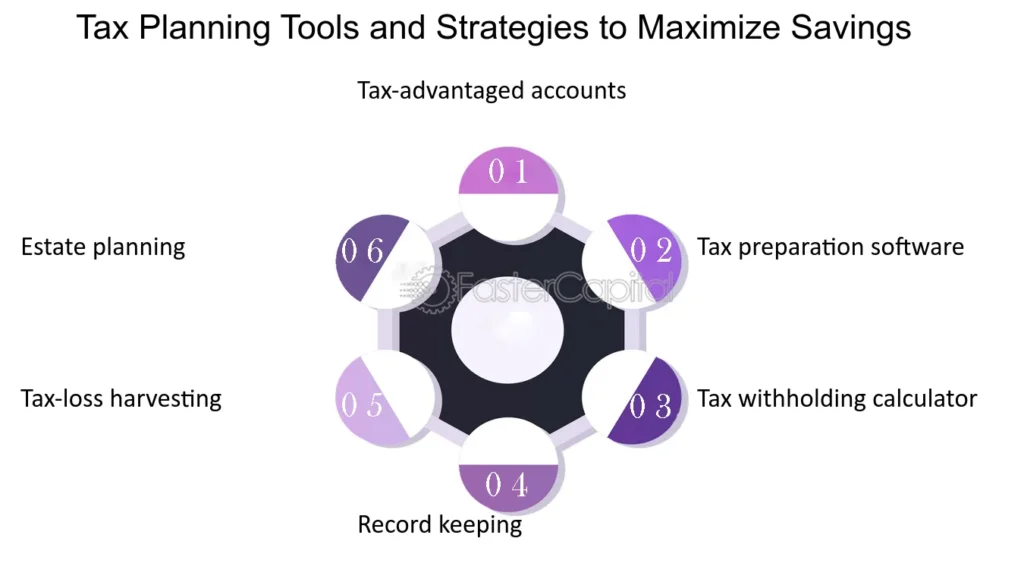

Strategically Utilizing Tax-Advantaged Tools

Individuals should carefully consider their eligibility, contribution limits, and investment options to maximize the effectiveness of tax-advantaged accounts. IRAs have income-based contribution limits, while Roth IRAs have income and contribution limits.

Additionally, individuals should select investment options that align with their risk tolerance and investment goals.

Tax-Advantaged Tools

Tax-advantaged tools refer to financial instruments or accounts that offer individuals specific tax benefits or advantages. These tools are designed to help taxpayers reduce their taxable income, defer taxes, or even enjoy tax-free growth or withdrawals under certain conditions. Here are some standard tax-advantaged tools:

Retirement Accounts:

- 401(k): Employer-sponsored retirement accounts allow employees to contribute a portion of their salary on a pre-tax basis, reducing taxable income.

- IRA (Individual Retirement Account): Individual retirement accounts that may be traditional (tax-deferred) or Roth (tax-free withdrawals).

Health Savings Account (HSA):

- A tax-advantaged account is available to individuals with high-deductible health plans. Contributions are tax-deductible, and withdrawals for qualified medical expenses are tax-free.

Flexible Spending Account (FSA):

- An employer-sponsored account that allows employees to set aside pre-tax dollars for qualified medical expenses.

529 Plans:

- State-sponsored education savings plans that offer tax advantages for saving for qualified higher education expenses.

Roth IRA Conversion:

- Converting funds from a traditional IRA to a Roth IRA, involves paying taxes on the converted amount but allows for tax-free withdrawals in retirement.

Municipal Bonds:

- Bonds issued by state or local governments that provide interest income exempt from federal income tax and, in some cases, state and local taxes.

Real Estate Investment Trusts (REITs):

- Investment vehicles that own, operate, or finance income-generating real estate. REIT dividends often receive favourable tax treatment.

Life Insurance:

- Specific life insurance policies, such as cash value or permanent life insurance, can offer tax-deferred growth and tax-free withdrawals under certain circumstances.

Small Business Retirement Plans:

- Plans like SEP-IRA, SIMPLE IRA, or Solo 401(k) for self-employed individuals and small business owners offer tax advantages for retirement savings.

- Energy Efficiency Credits:

- Tax credits for energy-efficient home improvements, such as solar panels, energy-efficient windows, or HVAC systems.

- Employer Stock Purchase Plans:

- Plans that allow employees to purchase company stock at a discounted price, often with favourable tax treatment.

- Qualified Opportunity Zones (QOZs):

- Investments in designated economically distressed areas that offer potential capital gains tax advantages.

It’s important to note that the availability and specifics of these tax-advantaged tools can vary by jurisdiction, and tax laws may change.

Additionally, the suitability of these tools depends on individual financial circumstances, goals, and risk tolerance. Seeking advice from a qualified tax professional or financial advisor is crucial when considering using tax-advantaged tools.

Strategic Investment Approaches for Tax-Advantaged Accounts

When it comes to building a robust financial portfolio, understanding the intricacies of tax-advantaged accounts is paramount. In this section, we will delve into the realm of investment strategies tailored specifically for tax-advantaged vehicles such as Individual Retirement Accounts (IRAs) and 401(k)s. Unveiling the secrets of successful wealth accumulation within these accounts involves going beyond mere contributions – it requires a nuanced approach to asset allocation, diversification, and risk management.

1. Strategic Asset Allocation: Maximizing Growth while Minimizing Risk

Crafting a well-thought-out asset allocation strategy is the cornerstone of optimizing tax-advantaged accounts. We will explore the art of strategically distributing your investments across various asset classes to strike a balance between growth potential and risk mitigation. Learn how to align your asset allocation with your financial goals, time horizon, and risk tolerance to create a resilient and dynamic investment portfolio.

2. Diversification Techniques: Building a Robust Financial Fortress

Diversification is not just a buzzword; it’s a powerful risk management tool. Discover how to spread your investments across different sectors, industries, and geographic regions within your tax-advantaged accounts. We’ll unravel the benefits of a diversified portfolio, including reduced volatility and enhanced potential for long-term growth. From stocks and bonds to alternative investments, find out how diversification can be your key to financial resilience.

3. Risk Management Strategies: Safeguarding Your Financial Future

Understanding and mitigating risk is a skill every savvy investor should possess. We’ll explore tailored risk management strategies designed for the unique features of tax-advantaged accounts. From assessing the risk-return profile of your investments to implementing safeguards against market downturns, you’ll gain insights into protecting your wealth while maximizing its growth potential.

4. Tax-Efficient Investment Approaches: Navigating the Regulatory Landscape

Tax-advantaged accounts offer a unique advantage – tax efficiency. Learn how to navigate the regulatory landscape to optimize your investment returns. From tax-efficient fund selection to utilizing tax-loss harvesting techniques, discover actionable strategies to minimize your tax liability and maximize the after-tax returns within your IRAs and 401(k)s.

5. Balancing Act: Adjusting Your Portfolio Over Time

As your financial goals evolve and market conditions change, so should your investment portfolio. We’ll discuss the importance of periodically reviewing and rebalancing your holdings within tax-advantaged accounts. Understand how to reallocate assets strategically to maintain your desired risk profile and ensure your investments align with your long-term objectives.

Whether you’re a seasoned investor or just starting on your wealth-building journey, this exploration of investment strategies within tax-advantaged accounts will equip you with the knowledge and tools needed to make informed decisions. Optimize your wealth accumulation journey by mastering the art and science of investing in IRAs and 401(k)s.

Investment Strategies within Tax-Advantaged Accounts

Let’s delve deeper into investment strategies within tax-advantaged accounts like IRAs and 401(k)s. These accounts offer unique opportunities for individuals to grow their wealth in a tax-efficient manner. Here are some key considerations:

- Asset Allocation:

- Diversification: Even within tax-advantaged accounts, diversification remains a crucial aspect of asset allocation. To mitigate risk, spread investments across different asset classes, such as stocks, bonds, and possibly real estate.

- Risk Tolerance: Assess your risk tolerance and investment horizon. While tax-advantaged accounts provide long-term growth potential, aligning your asset allocation with your comfort level for risk is essential.

- Life Stage Considerations: Adjust your asset allocation based on your life stage. Younger individuals may lean towards a more aggressive allocation with a higher percentage in equities, while those closer to retirement may consider a more conservative approach.

- Equity Investments:

- Index Funds and ETFs: Consider low-cost index funds or exchange-traded funds (ETFs) that track broad market indices. These options offer diversification and often lower fees than actively managed funds.

- Sector Diversification: Within equities, ensure diversification across different sectors. Avoid overconcentration in one industry to mitigate the impact of sector-specific risks.

- Fixed-Income Investments:

- Bond Funds: Including bond funds in your portfolio can provide stability and income. Consider a mix of government, corporate, and municipal bonds based on your risk profile.

- Duration Matching: Align the duration of your bond investments with your time horizon. Shorter-term bonds may be suitable for individuals with a nearer-term need for funds.

- Real Estate Investments:

- Real Estate Investment Trusts (REITs): Explore the inclusion of REITs within your tax-advantaged accounts. REITs provide exposure to real estate without the need for direct property ownership.

- Diversification in Real Assets: Consider investments in tax-advantaged accounts that provide exposure to real assets, such as infrastructure or commodities, to enhance diversification.

- Tax-Efficient Investing:

- Tax-Efficient Fund Placement: Be mindful of tax implications. Place tax-inefficient assets (those generating regular income) in tax-advantaged accounts, while tax-efficient assets (capital appreciation assets) may be held in taxable accounts.

- Tax-Loss Harvesting: Use tax-advantaged accounts for tax-loss harvesting strategies. Offset gains within the account against losses to minimize tax liabilities.

- Rebalancing Strategies:

- Periodic Review: Regularly review and rebalance your portfolio to maintain the desired asset allocation. Market fluctuations may cause deviations from your original plan.

- Tax-Efficient Rebalancing: When rebalancing, consider tax efficiency. Utilize new contributions or withdrawals strategically to rebalance without triggering unnecessary tax events.

- Target-Date Funds:

- Simplified Approach: For individuals seeking a hands-off approach, target-date funds automatically adjust asset allocation based on the investor’s anticipated retirement date. These funds provide a set-it-and-forget-it option.

- Roth Conversions:

- Strategic Conversions: Evaluate the benefits of strategic Roth conversions within tax-advantaged accounts. Converting a portion of traditional IRA assets to Roth IRAs can provide tax-free withdrawals in retirement.

- Consideration for Required Minimum Distributions (RMDs):

- Preparation for RMDs: Be mindful of RMD requirements for traditional IRAs and 401(k)s. Plan ahead for how RMDs may impact your overall investment strategy and tax situation in retirement.

- Professional Guidance:

- Financial Advisor Consultation: Given the complexity of investment strategies, especially within tax-advantaged accounts, consider consulting with a financial advisor. They can provide personalized advice based on your unique financial situation and goals.

Remember, the suitability of these strategies depends on individual circumstances, goals, and risk tolerance. Regularly reassess your investment strategy based on changes in your financial situation and market conditions. Always seek professional advice when needed.

Digital Tools and Apps for Financial Planning

Using digital tools and apps can significantly enhance the practical applicability of tax-free wealth accumulation strategies.

Here are some recommendations for digital tools and apps that can assist individuals in managing their finances, tracking contributions, and staying organized with their tax-advantaged accounts:

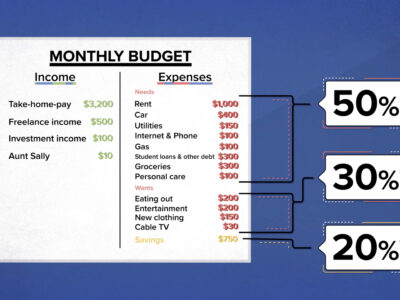

- Personal Finance and Budgeting:

- Mint: Mint is a comprehensive personal finance app that allows users to track expenses, create budgets, and set financial goals. It syncs with bank accounts, credit cards, and investment accounts, providing a holistic view of one’s financial health.

- YNAB (You Need A Budget): YNAB is a budgeting app that focuses on giving every dollar a job. It helps users allocate funds to specific categories, plan for upcoming expenses, and build savings.

- Investment Tracking:

- Personal Capital: Personal Capital is an investment management app that provides a dashboard for tracking investments, analyzing asset allocation, and monitoring overall portfolio performance. It also offers retirement planning tools.

- SigFig: SigFig is an investment tracking app that syncs with existing accounts to provide a consolidated view of investments. It offers portfolio analysis, investment recommendations, and alerts for potential issues.

- Tax Planning and Organization:

- TurboTax: TurboTax is a widely used tax preparation software that guides users through the tax filing process. It helps maximize deductions and ensures accurate reporting of income, making tax season less daunting.

- H&R Block Tax Prep: H&R Block’s tax preparation app is user-friendly and offers step-by-step guidance for filing taxes. It also provides tools for estimating tax liability and optimizing deductions.

- Retirement Planning:

- Fidelity Retirement Planner: Fidelity’s retirement planning tool helps users assess their retirement readiness. It considers factors like contributions, investment performance, and projected expenses to provide insights into retirement preparedness.

- Empower Retirement: For those with employer-sponsored retirement accounts, the Empower Retirement app offers features such as contribution tracking, investment management, and retirement planning resources.

- Expense Tracking and Receipt Management:

- Expensify: Expensify is a robust expense-tracking app that simplifies the process of recording expenses and managing receipts. It’s particularly useful for those who want to track business-related expenses.

- Shoeboxed: Shoeboxed is a receipt and expense tracking app that allows users to scan and organize receipts digitally. It helps streamline record-keeping for tax purposes.

- Financial Goal Setting:

- Goals by Ameriprise Financial: This app allows users to set and track financial goals. It visually represents progress toward goals, helping users stay motivated and focused on their objectives.

- PocketGuard: PocketGuard is a budgeting app that not only tracks expenses but also helps users set specific financial goals. It provides insights into spending patterns and suggests ways to save more.

Remember to research each app and choose the one that best aligns with your preferences and needs. Additionally, ensure personal and financial information security by using reputable and secure apps. These tools can be crucial in implementing and maintaining tax-free wealth accumulation strategies.

Harnessing the Power of Compounding

The Ultimate Tax-Free Wealth Blueprint emphasizes the power of compounding, a phenomenon where investment earnings generate additional earnings over time.

Whether you’re saving for retirement, investing in the stock market, or accumulating wealth, harnessing the power of compounding can significantly boost your financial success.

Here’s how you can do it:

- Start Early:

- Time is a critical factor in compounding. The earlier you start saving or investing, the more time your money has to grow. Even small contributions can turn into substantial sums over long periods.

- Reinvest Earnings:

- Reinvesting the earnings or interest you earn on your investments allows you to generate returns on the returns. This compounding effect accelerates wealth accumulation. For example, in a dividend reinvestment plan (DRIP), dividends are automatically used to buy more shares of the same investment.

- Compound Frequency:

- The more frequently interest is compounded, the faster your money grows. Compound interest can be calculated annually, semi-annually, quarterly, monthly, or even daily. The more frequent the compounding, the more you earn.

- Consistent Contributions:

- Regularly contributing to your savings or investment accounts ensures a steady influx of funds that can benefit from compounding. Consistency in contributions, even if they are small, adds up over time.

- Reinvest Tax Savings:

- Contributing to tax-advantaged accounts, such as IRAs or 401(k)s, can provide tax savings. Reinvesting the tax savings rather than spending them can enhance the compounding effect.

- Long-Term Perspective:

- Compounding works best over the long term. Avoid unnecessary withdrawals or liquidation of investments unless absolutely necessary. Patience is crucial in reaping the full benefits of compounding.

- Diversification:

- Diversifying your investments helps manage risk. Different asset classes and investment vehicles may have varying rates of return, but a diversified portfolio can provide stable, long-term growth.

- Avoid Market Timing:

- Trying to time the market by buying and selling based on short-term fluctuations can hinder the compounding process. Stay focused on your long-term goals and avoid emotional reactions to market volatility.

- Rebalance Your Portfolio:

- Periodically review and rebalance your investment portfolio to ensure it aligns with your risk tolerance and financial goals. This may involve selling some investments and buying others to maintain your desired asset allocation.

- Educate Yourself:

- Understand the different investment options, financial instruments, and their associated risks. Being informed allows you to make better decisions and maximize the benefits of compounding.

Remember that while compounding can work in your favor, it’s essential to know that investments carry risks and past performance does not indicate future results. Consult with a financial advisor to create a strategy that aligns with your goals and risk tolerance.

Unlocking a World of Passive Income Streams

The Ultimate Tax-Free Wealth Blueprint extends beyond mere wealth accumulation; it equips individuals with the knowledge and tools to unlock a world of passive income streams. Passive income refers to income earned without actively participating in the day-to-day operations of a business or investment.

The book unveils a range of passive income strategies, including real estate investing, rental income, dividend-paying stocks, and royalty income. These strategies allow individuals to generate a steady income stream without constant effort, providing financial stability and peace of mind.

Real Estate Investing

Real estate investing can be a lucrative source of passive income through rental properties. By strategically acquiring and managing rental properties, individuals can generate a steady stream of rental income, which can be reinvested to enhance their wealth further.

Rental Income

Rental income is generated from leasing properties, such as apartments, houses, or commercial spaces. The property owner’s rental income represents passive income, as it does not require active involvement in the property’s daily operations.

Dividend-Paying Stocks

Dividend-paying stocks are shares of companies that regularly distribute a portion of their profits to shareholders. By investing in dividend-paying stocks, individuals can receive a regular income stream as dividends.

Royalty Income

Royalty income is generated from licensing intellectual property, such as patents, copyrights, or trademarks. For instance, authors earn royalties from selling their books, while musicians earn royalties from using their music.

Balancing Tax-Free Strategies with Liquidity Needs

Balancing long-term tax-free wealth accumulation strategies with short-term liquidity needs is crucial to financial planning.

While tax-advantaged accounts like IRAs and 401(k)s offer significant benefits for long-term wealth growth, individuals may encounter situations that require access to funds before retirement.

Here’s a discussion on the importance of this balance and how to manage it effectively:

Importance of Balancing Tax-Free Strategies with Liquidity Needs:

- Emergency Expenses:

- Unforeseen circumstances such as medical emergencies, home repairs, or job loss may require immediate access to funds.

- Relying solely on tax-advantaged accounts for liquidity may result in penalties or tax implications, making it essential to maintain liquid assets.

- Short-Term Financial Goals:

- Individuals often have short-term financial goals such as buying a home, funding education or starting a business.

- Tax-advantaged accounts may not be the most efficient vehicle for these goals, necessitating a balance with more accessible investment options.

- Market Volatility:

- While long-term investments are suited for riding out market fluctuations, short-term needs may coincide with market downturns.

- Having readily available funds outside tax-advantaged accounts provides flexibility during market uncertainties.

Scenarios and Strategies for Short-Term Liquidity Needs:

- Establishing an Emergency Fund:

- Maintain a dedicated emergency fund in a liquid account (e.g., savings or money market) to cover three to six months’ worth of living expenses.

- This fund acts as a financial safety net, reducing the need to tap into tax-advantaged accounts during emergencies.

- Taxable Investment Accounts:

- Consider building a diversified portfolio in taxable investment accounts to address short-term goals.

- These accounts offer liquidity without the restrictions imposed on retirement accounts, allowing for easier access to funds when needed.

- Creating a Laddered CD Portfolio:

- Certificates of Deposit (CDs) with staggered maturity dates can provide a source of liquidity with a slightly higher yield than regular savings accounts.

- A laddered CD portfolio ensures access to funds periodically while potentially earning more than traditional savings accounts.

- Utilizing Roth IRA Contributions:

- Roth IRAs allow penalty-free withdrawal of contributed amounts (not earnings) at any time.

- While it’s generally advisable to let investments grow tax-free in a Roth IRA, utilizing contributed amounts can be a source of tax-free liquidity.

- Access to Home Equity:

- For homeowners, a home equity line of credit (HELOC) can be a flexible source of funds for short-term needs.

- However, it’s crucial to consider the risks associated with leveraging home equity.

- Strategic Use of Taxable Dividends:

- If investing in dividend-paying stocks, consider directing dividends to a taxable account to generate income that is not subject to early withdrawal penalties.

Managing the Balance:

- Regular Financial Reviews:

- Conduct periodic reviews of your financial situation, including both short-term needs and long-term goals.

- Adjust your asset allocation and investment strategy based on changing circumstances.

- Diversification of Assets:

- Diversify your investment portfolio to include a mix of asset classes and account types.

- This approach helps balance risk and liquidity needs, ensuring a well-rounded financial plan.

- Professional Financial Guidance:

- Consult with a financial advisor to tailor your investment and liquidity strategy to your unique circumstances.

- Professionals can provide personalized advice based on your goals, risk tolerance, and the current economic landscape.

- Flexibility in Retirement Planning:

- Maintain flexibility in your retirement planning strategy to accommodate unforeseen events.

- Be prepared to adjust contributions, withdrawals, or investment allocations based on evolving needs.

Balancing long-term tax-free wealth accumulation with short-term liquidity needs requires a thoughtful and dynamic approach to financial planning. By carefully considering various investment vehicles and regularly reassessing your financial situation, you can balance long-term growth and short-term access to funds.

A Comprehensive Roadmap to Financial Empowerment

The Ultimate Tax-Free Wealth Blueprint is a comprehensive guide that provides a well-structured roadmap for achieving financial freedom. The Ultimate Tax-Free Wealth Blueprint PDF delves into various aspects of financial planning, including:

- Navigating the complexities of tax laws and regulations:

- Understanding tax laws and regulations is crucial for optimizing financial decisions. Tax laws vary by jurisdiction and can be complex. Navigating them involves staying informed about changes, taking advantage of available deductions and credits, and ensuring compliance with tax obligations.

- Selecting the appropriate investment vehicles to align with individual goals and risk tolerance:

- Choosing the right investment vehicles is key to achieving financial goals while managing risk. This process involves assessing individual risk tolerance, time horizon, and investment objectives. Standard investment vehicles include stocks, bonds, mutual funds, real estate, and various retirement accounts.

- Developing a personalized investment portfolio tailored to specific financial objectives:

- A personalized investment portfolio is crafted based on an individual’s unique financial goals, risk tolerance, and time horizon. It involves selecting a mix of assets that align with the individual’s objectives, such as growth, income, or capital preservation, and periodically adjusting the portfolio to adapt to changing circumstances.

- Maximizing tax deductions and credits to reduce overall tax liability:

- Strategic tax planning involves identifying opportunities to minimize tax liability through deductions and credits. This can include contributions to tax-advantaged accounts, taking advantage of available credits, and structuring financial transactions tax-efficiently.

- Creating a comprehensive estate plan to ensure the secure transfer of assets to beneficiaries:

- Estate planning involves structuring assets to facilitate transfer to heirs while minimizing tax implications. This may include the creation of wills, trusts, and the designation of beneficiaries for various accounts. Estate planning aims to ensure a smooth and secure transfer of assets in accordance with the individual’s wishes.

- Navigating retirement planning strategies to ensure a comfortable and financially secure retirement:

- Retirement planning involves assessing future income needs, determining appropriate savings targets, and selecting retirement accounts and investment strategies. Maximizing contributions to tax-advantaged retirement accounts and developing a withdrawal strategy are key components of effective retirement planning.

- Exploring advanced wealth accumulation strategies, such as cash value life insurance and self-directed IRAs:

- Advanced wealth accumulation strategies involve leveraging financial instruments to optimize wealth growth. Cash value life insurance can offer both a death benefit and a cash accumulation component. Self-directed IRAs allow individuals to invest in a broader range of assets beyond traditional stocks and bonds, potentially enhancing wealth accumulation.

In summary, successfully navigating these financial complexities requires a combination of financial literacy, strategic planning, and often the assistance of financial professionals such as financial advisors, tax consultants, and estate planning attorneys. The goal is to create a holistic and personalized financial strategy that aligns with individual goals and ensures financial well-being across different life stages.

Through in-depth explanations, practical advice, and real-world examples, the Tax-Free Wealth book empowers individuals to make informed financial decisions and take control of their financial future.

Case Studies and Real-Life Examples

While specific details will vary based on individual circumstances, here are a couple of hypothetical case studies illustrating how individuals might implement tax-free wealth accumulation strategies:

Case Study 1: Maximize Roth IRA Contributions for Tax-Free Growth

Background:

Emily, a 30-year-old professional, wanted to build tax-free wealth for her retirement. She earned a steady income and had a traditional 401(k) through her employer. She decided to prioritize Roth IRA contributions alongside her employer-sponsored retirement plan.

Strategy:

- Maximizing Roth IRA Contributions: Emily contributed the maximum allowed amount to her Roth IRA each year. As Roth contributions are made with after-tax dollars, she anticipated tax-free withdrawals in retirement.

- Diversified Portfolio: Emily diversified her investments across low-cost index funds and some individual stocks within her Roth IRA. She chose a mix of growth and dividend-paying stocks to benefit from potential capital appreciation and tax-free dividends.

- Regular Rebalancing: Emily periodically reviewed and rebalanced her portfolio to maintain her desired asset allocation. This helped her stay aligned with her risk tolerance and financial goals.

Outcome:

Over the years, Emily’s Roth IRA grew significantly due to a combination of contributions, investment returns, and tax-free compounding. She had a substantial tax-free nest egg when she reached retirement age, providing her with financial flexibility and peace of mind.

Case Study 2: Strategic Roth Conversions for Tax Diversification

Background:

James, a 45-year-old business owner, had a substantial amount in his traditional IRA. Concerned about potential tax implications in retirement, he sought a strategy to create tax diversification.

Strategy:

- Strategic Roth Conversions: James implemented a strategic plan to convert a portion of his traditional IRA to a Roth IRA each year. He analyzed his tax bracket and converted an amount that kept him in a lower tax bracket.

- Diversified Investments: Within his Roth IRA, James diversified investments across asset classes. He used the Roth account to hold investments expected to have high future returns.

- Continued Contributions: James continued contributing to his traditional 401(k) and Roth IRA, ensuring a mix of pre-tax and tax-free assets.

Outcome:

By the time James retired, he had successfully created tax diversification. He could choose between tax-free withdrawals from his Roth IRA and potentially lower-taxed withdrawals from his traditional 401(k), providing him with flexibility in managing his tax liability in retirement.

These case studies illustrate how individuals can strategically implement tax-free wealth accumulation strategies based on their unique circumstances and financial goals. Readers must adapt these strategies and consult a financial advisor for personalized advice.

Embarking on a Journey of Financial Independence

The Ultimate Tax-Free Wealth Blueprint is invaluable for individuals seeking financial freedom. It explains tax-advantaged wealth accumulation, passive income strategies, and comprehensive financial planning.

By embracing the principles outlined in the book, individuals can embark on a journey toward financial independence, unlocking the potential to build a secure financial future and achieve their long-term financial goals. With knowledge, discipline, and dedication, financial freedom becomes attainable, empowering individuals to live a life filled with financial security and the freedom to pursue their passions.

Additional Insights and Considerations

The path toward financial freedom is not without its challenges and complexities. It requires patience, discipline, and a willingness to make informed financial decisions. The Ultimate Tax-Free Wealth Blueprint is a valuable guide for navigating this journey, equipping individuals with the tools and knowledge to make sound financial choices and achieve their long-term goals.

It is essential to recognize that financial freedom is a personal journey, and the strategies outlined in the book may need to be adapted to suit individual circumstances and preferences. The book emphasizes the importance of seeking professional guidance from qualified financial advisors who can provide personalized advice tailored to specific needs and risk profiles.

Conclusion: Tax-Free Wealth

Ultimately, The Ultimate Tax-Free Wealth Blueprint empowers individuals to take control of their financial destiny and chart a course toward financial independence. By embracing the principles outlined in the book and seeking guidance from trusted financial professionals, individuals can unlock the potential to achieve financial security and confidently pursue their dreams.

Discover more from Digital Wealth Guru

Subscribe to get the latest posts sent to your email.

Comments